The post What is Tokenomics? A Crash Course in Crypto Token Economics appeared first on Scaleswap.

]]>Not many initially understand what tokenomics actually means, but ultimately, this is an aspect of any project that plays a major role when it comes to investor choice in regards to deciding if it has future growth potential.

Given the fact that there is a continuous level of growth when it comes to the sheer amount of coins and tokens available within the market, it is paramount for investors in the crypto sphere to familiarize themselves with the term in question and to truly grasp the concept of tokenomics, and get a high level of understanding of how this term can be used as a means of to maximize profitable and lasting investment opportunities.

With all of this in mind, we will now be going over just about everything, so you can be as comfortable as possible the next time you review a cryptocurrency project prior to making an investment decision.

What is Tokenomics for a Crypto Token?

Tokenomics are the methodology and backbone of the token economy. What this means is that it covers just about all aspects that involve a coin or token’s creation, management, and removal from a specific network.

This information will typically include the functionality surrounding the token, the objective, the allocation policy, as well as the schedule of emissions, as all of these aspects play an important role when it comes to considerations from investors. In other words, investors take into consideration all aspects of a coin or token prior to committing their funds.

Furthermore, tokenomics are fundamental to the overall cryptocurrency ecosystem due to the fact that they allow projects to prevent any potential bad actors and create trust, alongside building a solid community that can boost its overall long-term ecosystem and success.

Whenever a project features economics that is strong, it essentially will be able to support the value of the token throughout the long-term and incentivize early adopters whilst also controlling a token’s inflation rate and promoting sustainable growth.

With all of this in mind, remember that there are many different metrics that investors will typically need to keep in mind when it comes to grasping the economics surrounding a project’s token.

Most of the information on a token’s economics can be obtained online easily. However, it is always a bright idea to go over the project’s whitepaper to ensure that all of the information offered on various other platforms is correct. This will also aid any investor in identifying if a project is a fraud or a rug-pull scheme, assuming they find any red flags surrounding the whitepaper.

Which Factors Are Included in Token Economics?

There are numerous factors that need to be taken into consideration when it comes to researching for a token, coin, or a project that an investor might be interested in as a means of ensuring that they have the best odds of succeeding and provide them with a solid ROI (return-on-investment) in the long term, and we are going to go over the main factors.

The Allocation and Distribution of Tokens

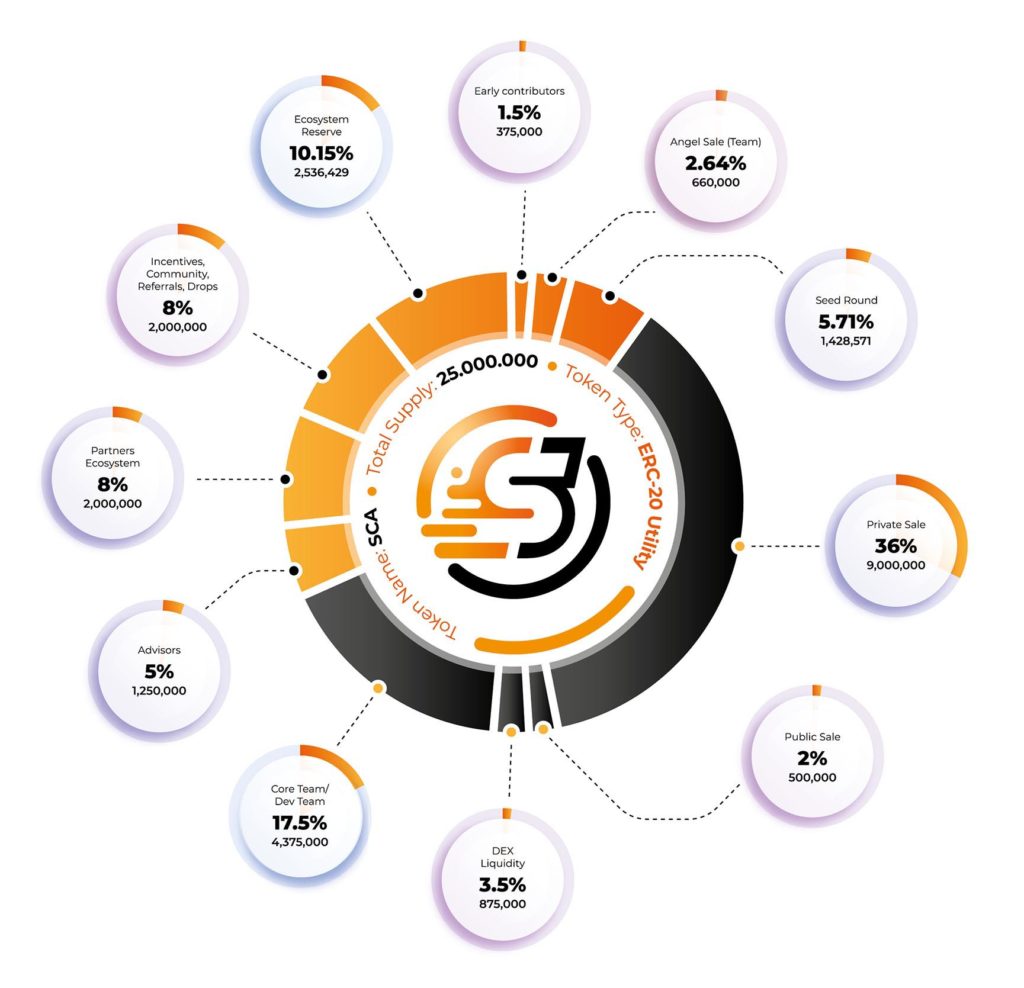

The first factor that you will need to take into consideration is token allocation and distribution. In other words, every single whitepaper you review will have a chart, typically in the form of a pie chart; however, this can be anything else as well, which will give you an indication of how much percentage of tokens goes to which part of the project.

This plays a major role in the initial launch stages of the project due to the fact that the executive team, or in some cases, even the community, can decide on how many tokens are allocated or distributed. This means that the tokens are divided between different departments, such as marketing and development, where some tokens are allocated to the treasury while others are offered up to investors. Additionally, the team members that are working on a project might also receive tokens as a reward for their hard work, and all of this transparent information will assist investors in the overall process of gaining an insight into the initial validation of a project, which is based on the amount of money that it raises throughout these early stages.

Here is what an example of token allocation would look like:

- Private Sale –this is a sale to partners or investment funds.

- Public Sale –this is a percentage of the tokens that are open for sales on IDO platforms.

- Team –this would be the tokens that are allocated as an incentive to the project’s founders, employees, and overall freelancers. Typically, the token has a vesting period of 24 months.

- Strategic Partners –This is typically the percentage that Is allocated towards incentivizing partners during a project’s overall development.

- Advisory – this percentage is typically given to incentivize the advisory partner.

- Marketing – this portion is allocated as a reward for community activities and will go towards content creators and developers who actively contribute to the growth of the ecosystem and overall marketing.

- Liquidity – this is allocated towards creating liquidity for the specific tokens quickly.

- Reverse Fund – this is typically created to minimize the risks when it comes to the crypto market fluctuations or any unexpected incidents and supports the overall ecosystem.

However, the token distribution aspect is an essential factor that always needs to be examined, as it will help you find out how many tokens were initially distributed, throughout the pre-mining, ICOs, and so on, as well as what percentage of the tokens are owned by owners, funders, developers, or partners of the project. You can also have an in-depth look this way at the maximum percentage public investors can own and how many tokens are locked-up and reserved for future distributions.

The Supply of the Token

The primary component surrounding a cryptocurrency’s tokenomics is its supply. There are a total of three types of token supply.

As a cryptocurrency investor, the supply of the token will answer some burning questions that you might have, such as how many tokens exist, how many more can be created in the future, and are there any tokens not in circulation.

These are:

- The Circulating Supply – this is the amount of coins or tokens that are circulating within the market and that are actually owned by people that have cryptocurrency wallets.

- The Total Supply – this is a representation of the all the possible number of coins or tokens that can ever exist throughout that specific project and ecosystem or blockchain network.

- The Maximum Supply – this is a representation of all the amount of coins or tokens that are issued until the point in time that you are viewing the project and is not an indication of the ones in circulation. However, this amount does include the burned coins or the locked-up coins that are ready to be unlocked in the future.

So now you might be asking yourself why this information is relevant for investors. This is relevant due to the fact that it is a perfect indication of the supply and the overall demand. For example, if an asset were to become scarce and there is high demand for it, this would result in an increased price for that specific asset. However, if an asset does not have a maximum supply, this could lead to an abundance of the coin within the market, which would decrease the price. While this is not always the case, it is still possible that a cryptocurrency trader or investor can consider and analyze the procedure. Additionally, they can affect the overall price whenever locked-up coins are released. This type of analysis is possible only when you end up checking the current supply values of the coins.

Market Capitalization

The market capitalization aspect of the token is a representation of the entire amount of funds that have already been invested. Alongside the overall market capitalization, an investor might also want to review the fully diluted market capitalization surrounding a project, which is actually the theoretical market capitalization, assuming the maximum supply of the token was already pushed into circulation.

The primary goal of market capitalization is to provide investors with an estimation on how to value a token due to the fact that the higher a token’s market capitalization ends up getting, whilst also having a limited supply in circulation, the more upside the asset has for growth in the future.

The Token Model

Two token models dominate the crypto space, and if you are serious about making investments within the crypto sphere and aim to make a well-educated decision, it is important that you go over each option independently to see which model makes a lot more sense in your case. The token can be either inflationary or deflationary. We will go over each token model a bit more in-depth, so you can have a heightened level of understanding as to how both of them work.

The Inflationary Token Model

The number of total tokens that can be minted is limitless in this model, and can be minted throughout its economic model. What this essentially means is that the token supply can only increase as time progresses.

There are a plethora of inflationary model examples, where some release tokens on a fixed schedule, others use non-linear functions, and some even mint tokens whenever there is demand for them to exist.

These inflationary token models will typically need to follow pre-specified rules as a means for them to function efficiently.

For example, the inflationary token model must not allow an on-demand token minting mechanism. In other words, a project’s team must not issue new tokens as they see fit due to the fact that if the public looks at the contract node and notices that the creators can mint an unlimited number of tokens at any point in time, they will typically run away from the project.

As such, the main way through which most projects handle minting new tokens is through staking or mining, which are the driving force behind the inflationary token models. Within the staking model specifically, token holders approve the transactions and maintain the security of a network. As a result of this, validators can receive token rewards for supporting the overall network, and these token rewards minted for the network validators in the block creation process are what cause market inflation.

The Deflationary Approach

A deflationary version would indicate a “hard cap” or restriction on the total amount of tokens that can actually be minted. Within this model, the token supply is designed to only decrease throughout time.

Deflationary token models are made possible through the utilization of a mechanism known as token burn. Token burning is the process of a token getting permanently removed from the overall system. There are two primary ways through which token burns are performed throughout the deflationary token models.

Buying and burn are one of these models, where the platform or the token creators essentially purchase tokens off the marketplace and export them to a “burn” wallet on purpose where they can be unrecoverable.

Then there’s the second model, known as the burn-on-transaction model, which is an automatic mechanism which is defined within the token’s smart contract, that burns a specific amount of the token from each transaction. This type of token model is typically simpler to design, which means that many new projects will opt in towards using this model for their tokenomics. This is due to the fact that the deflationary token model makes it a lot easier to increase the token’s value over time due to the fact that the supply can only decrease over time.

How To Evaluate Tokenomics Properly

Studying the tokenomics surrounding cryptocurrency projects can play an integral role in your analysis, especially throughout the early stages when you are gearing towards learning as much about blockchain technology as possible.

A detailed, as well as a robust tokenomics whitepaper can break or make a project’s future. This means that you never want to invest in a project that has poor tokenomics. However, after all of the aforementioned information, you might be wondering how you can evaluate tokenomics properly.

To do this, here are some key steps that you need to make in order to make the best possible decision:

- Check the funding goal surrounding the project

- Take an in-depth look at the overall allocation details

- Figure out what the vesting schedule of a project looks like

- Evaluate the overall purpose of the token

- Conduct an in-depth analysis of what the goals surrounding the project actually are

- Watch this video for additional tips on project evaluation

Need Some Help with your Tokenomics?

Remember that It can initially be difficult to truly understand how tokenomics works, especially throughout the span of a single day, week, or even month. However, when you put in the time, commitment and effort, you will undoubtedly get familiar with tokenomics and can evaluate all future projects you decide to invest in with ease.

For the time being, however, if you do indeed require some assistance when it comes to figuring out tokenomics, you can utilize the service on offer by ScaleSwap, which can help crypto startups design tokenomics through the advisory incubation and acceleration services.

When it comes to launching a token within the crypto sphere, any project would want a reliable and professional partner, and this is where Scaleswap fits within this picture. The team behind Scaleswap can provide your project with solid and practical advice that can pave the way to a successful launch. From the strategy surrounding marketing to economics and overall technical assistance, Scaleswap can aid you in covering all bases when launching a new project.

The post What is Tokenomics? A Crash Course in Crypto Token Economics appeared first on Scaleswap.

]]>The post IDO Guide for Investors: A Complete IDO Plan for Beginners appeared first on Scaleswap.

]]>Where Are IDOs Headed in the Future?

The cryptocurrency market is changing fast, just in a couple of years, we had a major evolution from the ICO moel to an IDO model. Recently we compared these various models of investing in our What Is an IDO and Why It Matters Article.

IDOs and their launchpads are becoming the future of fundraising, and the increasing number of cases validate the model’s potential. The IDO model is likely to become the most popular blockchain-based fundraising technique in the future. But with its solutions and innovations, new problems appear.

The Hidden Problems

No matter how many times you heard of people successfully investing in a cryptocurrency that paid off big, there were equally, or even more people who barely made any money back or lost all of it in a bad project investment or scam.

In fact, in 2020, there were over 80,000 cryptocurrency scams in the US alone according to Forbes. And this number is set to increase drastically with all the capital coming into crypto, combined with many new people.

These scams are frequent in the crypto investing space, and are often manifested in one of these 3 main ways:

- Luring investors into ICO/IDO scams where projects are being abandoned within days or months.

- Pump-and-dump schemes where the token price skyrocket and then plummet within hours, leaving most IDO participants losing 99% of their money

- Scams that involve account hacking.

With so many crypto scams our first and foremost priority is to avoid them by choosing carefully.

How to Choose an IDO For Investment

Now even if you invest in a legit project, it still might not pay off because it’s simply not good enough. We have to look for a few important details that signal integrity and a high chance of success for an IDO investment.

Look for an experienced team of professionals

The first important thing to check in IDO is the team, backers, and community. Real professional people and engaged community members will create and drive real value, and not empty promises.

The team plays a crucial role when creating projects. Find out as much as you can about the team, including track record, developers, and transparency. Look for evidence of prior success and watch out for red flags.

Although like most startups it might consist of young talents that lack blockchain experience but looking at their past employment and achievements should give you a clue about how well they can deliver on the project, and if they’ve worked with reputable projects in the past.

The executive team should be scrutinized the most. Pay close attention to their CEO, CTO, CVO, CMO, and advisory team.

Lastly, look for transparency. It’s important to spot attempts that have been made by the project to be transparent and communicative.

If the team is anonymous then look for alternative ways to verify the integrity of the team. Such as looking for testimonials of other trustworthy individuals or looking over their GitHub projects

Weigh the Product-Market Fit

IDOs just like any other startup require finding the right product-market fit.

And some projects that perform well at one point in time, may perform poorly at another point in time. Likewise, projects that seem less mainstream at the launch, can evolve into just what the market needs after some time.

Product zeitgeist-fit is a term that is often used for describing; a successful product + with the right timing + suitable society mindset. This is the key to the success of the project.

One of the best ways to look for product zeitgeist-fit is to stay updated about the industry, and have a general understanding of trends and the market.

If you don’t understand the industry that well, then pay attention to what problems are being solved by the project. Effectively solving painful and common problems is one of the simplest ways to determine the value of the project.

Is the Token or Asset Undervalued?

Looking for an undervalued asset is one of the most common ways to spot a good investment opportunity.

Looking at the total market valuation and the scale of the problem being solved is a good starting point. Projects that have an initial market cap lower than their expected value can signal an attractive investment opportunity since the market tends to move the token price toward its right value.

In general, a project that launch an IDO with a lower than expected market cap has a higher chance of gaining value over time. On the other side projects that launch with a higher than expected market cap, often fall back.

If the project hasn’t launched yet, then check the token amount that will start circulating after its token generation event (TGE), which is often found in Tokenomics.

Analyze Tokenomics

Launching a token successfully requires making sure that the economics of the token support the project in the long term. Tokenomics that support the short term often end up with no plans for future distribution, making it at risk of immediate dumping by the founders, or the early stage buyers.

Look for these features instead:

- Long-term locked periods of the tokens (up to years) for the team and early investors even after the milestones of the project are met.

- Vesting periods ensure that IDO participants will lock liquidity into pools instead of selling the tokens early. The more tokens are locked into liquidity pools the better because fewer tokens circulate in the free market. More frequent and longer period token generation events (TGE) usually support this.

- Who and how much owns the tokens? – Too many tokens distributed to investors or the team causes a different form of centralization and are vulnerable to dumping. Big portions of tokens distributed to influencers are more likely to sell all their tokens early which makes the price fall. Diversity of distribution is a good sign.

Look for Strong Communities

A supportive community is the backbone of the crypto project.

The vast majority of projects are unable to sustain the same levels of hype and interest which often naturally settles down once the hype runs out of steam. An engaged community that sticks around is a big positive for crypto projects that involve people.

Numbers aren’t everything – There are a lot of bots and shilling, instead, dig deeper and look for meaningful engagement.

Bonus; but that’s not all. If a project manages to stay on course by keeping a consistent momentum long after the token sale. By managing project development even after the hype has died. It shows the integrity and hard work of the team, which can signal an undervalued investment opportunity.

IDOs are Not Always Profitable

Not everything is as good as it sounds. While you can make good returns on investment there will always be some degree of risk involved.

Nonetheless, through careful project selection and solid IDO research, you can dramatically minimize this risk and maximize your profits.

A lot of money coming into an industry fast can create a lot of gaps for inefficiency and room for scammers. With all the capital and investors there follows a lot of copycats and scammers trying to get easy money from the investors.

Tips to Stay Safe

With so many new people and innovations, scamming becomes a common practice. Here are the main tips to avoid scammers.

- Copying a website, and sending fake emails that attempt to steal your funds, is a common scam that you must be aware of.

- Refer only to official announcements & emails from a project.

- Scammers may attempt to impersonate project team members. Always remember that team/admins will NEVER initiate a DM first. We will never request funds, passwords, or private keys for any reason whatsoever.

- Lastly, store your secret phase where no one can get access to it and where it is disconnected from the internet is stored on a device. The secret phase is the main key to your crypto wallet.

Choose the Right Launchpad

Choosing the Right IDO Launchpad will make things much easier in participating in this one-of-a-kind industry. To find the right one, make sure it aligns with your goals, but also gives fairness, transparency, high-quality projects to choose from, and has the multi-chain support needed for the future.

It is critical to choose a launchpad you can trust because many lack the necessary commitment and experience to keep you safe from losing your money.

Scaleswap Minimizes Risks of an IDO

Scaleswap is dedicated to providing you with a truly fair, secure, and exciting IDO experience. Scalswap does half of the job for you by having an unparalleled project vetting and selection process.

Learn more about Scaleswap and its selection process:

How Can You Participate in an IDO with ScaleSwap?

Everyone can become a participant in an IDO with Scaleswap!

If you’re new to the IDO process then getting started can sometimes seem overwhelming. Don’t worry! We’re here to guide you through each step. Here are the resources you’ll need to get started today:

- Check out our How to Get Started with Scaleswap Article that will guide you through the details.

- If you’re brand new to crypto then check out our free Quick Start Guide to Using Crypto PDF.

The post IDO Guide for Investors: A Complete IDO Plan for Beginners appeared first on Scaleswap.

]]>