If you have been following the cryptocurrency industry for quite a while now or are just starting to dip your toes within the overall sphere, you might have encountered “tokenomics.”

Not many initially understand what tokenomics actually means, but ultimately, this is an aspect of any project that plays a major role when it comes to investor choice in regards to deciding if it has future growth potential.

Given the fact that there is a continuous level of growth when it comes to the sheer amount of coins and tokens available within the market, it is paramount for investors in the crypto sphere to familiarize themselves with the term in question and to truly grasp the concept of tokenomics, and get a high level of understanding of how this term can be used as a means of to maximize profitable and lasting investment opportunities.

With all of this in mind, we will now be going over just about everything, so you can be as comfortable as possible the next time you review a cryptocurrency project prior to making an investment decision.

What is Tokenomics for a Crypto Token?

Tokenomics are the methodology and backbone of the token economy. What this means is that it covers just about all aspects that involve a coin or token’s creation, management, and removal from a specific network.

This information will typically include the functionality surrounding the token, the objective, the allocation policy, as well as the schedule of emissions, as all of these aspects play an important role when it comes to considerations from investors. In other words, investors take into consideration all aspects of a coin or token prior to committing their funds.

Furthermore, tokenomics are fundamental to the overall cryptocurrency ecosystem due to the fact that they allow projects to prevent any potential bad actors and create trust, alongside building a solid community that can boost its overall long-term ecosystem and success.

Whenever a project features economics that is strong, it essentially will be able to support the value of the token throughout the long-term and incentivize early adopters whilst also controlling a token’s inflation rate and promoting sustainable growth.

With all of this in mind, remember that there are many different metrics that investors will typically need to keep in mind when it comes to grasping the economics surrounding a project’s token.

Most of the information on a token’s economics can be obtained online easily. However, it is always a bright idea to go over the project’s whitepaper to ensure that all of the information offered on various other platforms is correct. This will also aid any investor in identifying if a project is a fraud or a rug-pull scheme, assuming they find any red flags surrounding the whitepaper.

Which Factors Are Included in Token Economics?

There are numerous factors that need to be taken into consideration when it comes to researching for a token, coin, or a project that an investor might be interested in as a means of ensuring that they have the best odds of succeeding and provide them with a solid ROI (return-on-investment) in the long term, and we are going to go over the main factors.

The Allocation and Distribution of Tokens

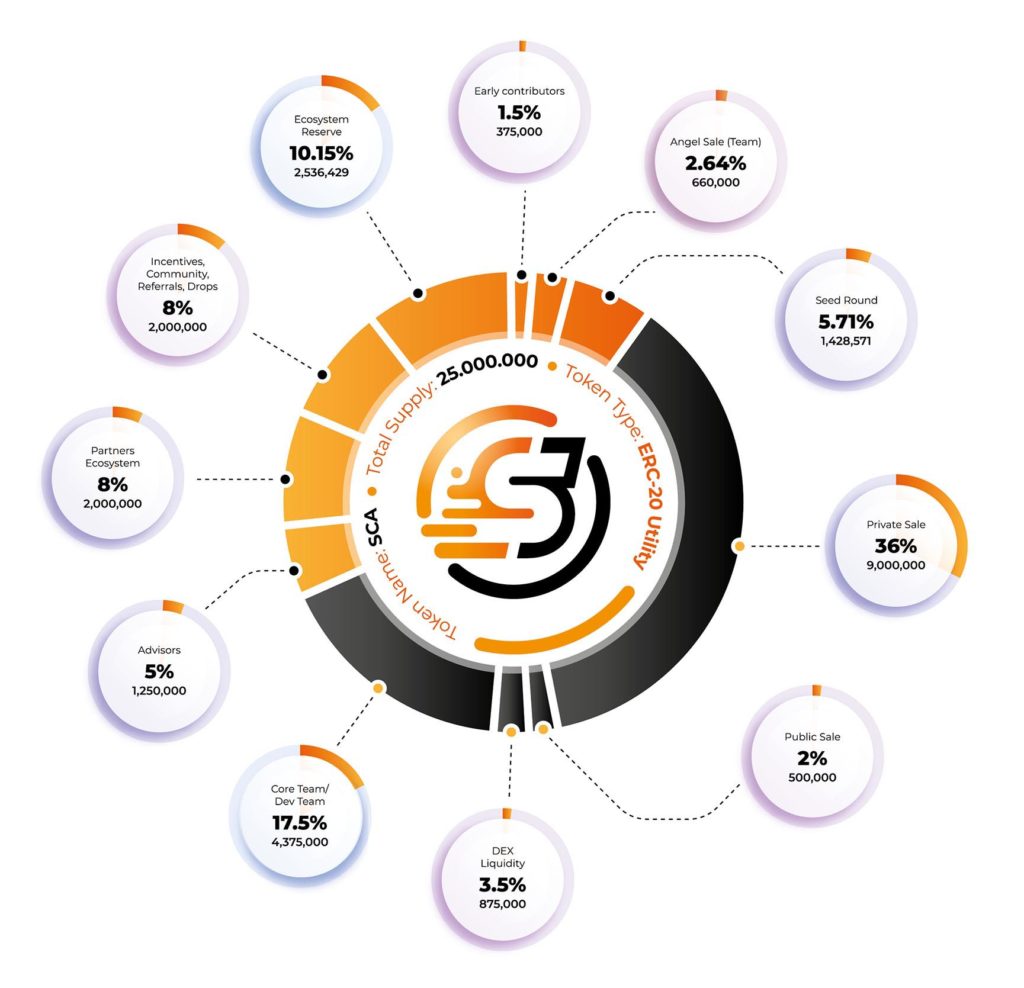

The first factor that you will need to take into consideration is token allocation and distribution. In other words, every single whitepaper you review will have a chart, typically in the form of a pie chart; however, this can be anything else as well, which will give you an indication of how much percentage of tokens goes to which part of the project.

This plays a major role in the initial launch stages of the project due to the fact that the executive team, or in some cases, even the community, can decide on how many tokens are allocated or distributed. This means that the tokens are divided between different departments, such as marketing and development, where some tokens are allocated to the treasury while others are offered up to investors. Additionally, the team members that are working on a project might also receive tokens as a reward for their hard work, and all of this transparent information will assist investors in the overall process of gaining an insight into the initial validation of a project, which is based on the amount of money that it raises throughout these early stages.

Here is what an example of token allocation would look like:

- Private Sale –this is a sale to partners or investment funds.

- Public Sale –this is a percentage of the tokens that are open for sales on IDO platforms.

- Team –this would be the tokens that are allocated as an incentive to the project’s founders, employees, and overall freelancers. Typically, the token has a vesting period of 24 months.

- Strategic Partners –This is typically the percentage that Is allocated towards incentivizing partners during a project’s overall development.

- Advisory – this percentage is typically given to incentivize the advisory partner.

- Marketing – this portion is allocated as a reward for community activities and will go towards content creators and developers who actively contribute to the growth of the ecosystem and overall marketing.

- Liquidity – this is allocated towards creating liquidity for the specific tokens quickly.

- Reverse Fund – this is typically created to minimize the risks when it comes to the crypto market fluctuations or any unexpected incidents and supports the overall ecosystem.

However, the token distribution aspect is an essential factor that always needs to be examined, as it will help you find out how many tokens were initially distributed, throughout the pre-mining, ICOs, and so on, as well as what percentage of the tokens are owned by owners, funders, developers, or partners of the project. You can also have an in-depth look this way at the maximum percentage public investors can own and how many tokens are locked-up and reserved for future distributions.

The Supply of the Token

The primary component surrounding a cryptocurrency’s tokenomics is its supply. There are a total of three types of token supply.

As a cryptocurrency investor, the supply of the token will answer some burning questions that you might have, such as how many tokens exist, how many more can be created in the future, and are there any tokens not in circulation.

These are:

- The Circulating Supply – this is the amount of coins or tokens that are circulating within the market and that are actually owned by people that have cryptocurrency wallets.

- The Total Supply – this is a representation of the all the possible number of coins or tokens that can ever exist throughout that specific project and ecosystem or blockchain network.

- The Maximum Supply – this is a representation of all the amount of coins or tokens that are issued until the point in time that you are viewing the project and is not an indication of the ones in circulation. However, this amount does include the burned coins or the locked-up coins that are ready to be unlocked in the future.

So now you might be asking yourself why this information is relevant for investors. This is relevant due to the fact that it is a perfect indication of the supply and the overall demand. For example, if an asset were to become scarce and there is high demand for it, this would result in an increased price for that specific asset. However, if an asset does not have a maximum supply, this could lead to an abundance of the coin within the market, which would decrease the price. While this is not always the case, it is still possible that a cryptocurrency trader or investor can consider and analyze the procedure. Additionally, they can affect the overall price whenever locked-up coins are released. This type of analysis is possible only when you end up checking the current supply values of the coins.

Market Capitalization

The market capitalization aspect of the token is a representation of the entire amount of funds that have already been invested. Alongside the overall market capitalization, an investor might also want to review the fully diluted market capitalization surrounding a project, which is actually the theoretical market capitalization, assuming the maximum supply of the token was already pushed into circulation.

The primary goal of market capitalization is to provide investors with an estimation on how to value a token due to the fact that the higher a token’s market capitalization ends up getting, whilst also having a limited supply in circulation, the more upside the asset has for growth in the future.

The Token Model

Two token models dominate the crypto space, and if you are serious about making investments within the crypto sphere and aim to make a well-educated decision, it is important that you go over each option independently to see which model makes a lot more sense in your case. The token can be either inflationary or deflationary. We will go over each token model a bit more in-depth, so you can have a heightened level of understanding as to how both of them work.

The Inflationary Token Model

The number of total tokens that can be minted is limitless in this model, and can be minted throughout its economic model. What this essentially means is that the token supply can only increase as time progresses.

There are a plethora of inflationary model examples, where some release tokens on a fixed schedule, others use non-linear functions, and some even mint tokens whenever there is demand for them to exist.

These inflationary token models will typically need to follow pre-specified rules as a means for them to function efficiently.

For example, the inflationary token model must not allow an on-demand token minting mechanism. In other words, a project’s team must not issue new tokens as they see fit due to the fact that if the public looks at the contract node and notices that the creators can mint an unlimited number of tokens at any point in time, they will typically run away from the project.

As such, the main way through which most projects handle minting new tokens is through staking or mining, which are the driving force behind the inflationary token models. Within the staking model specifically, token holders approve the transactions and maintain the security of a network. As a result of this, validators can receive token rewards for supporting the overall network, and these token rewards minted for the network validators in the block creation process are what cause market inflation.

The Deflationary Approach

A deflationary version would indicate a “hard cap” or restriction on the total amount of tokens that can actually be minted. Within this model, the token supply is designed to only decrease throughout time.

Deflationary token models are made possible through the utilization of a mechanism known as token burn. Token burning is the process of a token getting permanently removed from the overall system. There are two primary ways through which token burns are performed throughout the deflationary token models.

Buying and burn are one of these models, where the platform or the token creators essentially purchase tokens off the marketplace and export them to a “burn” wallet on purpose where they can be unrecoverable.

Then there’s the second model, known as the burn-on-transaction model, which is an automatic mechanism which is defined within the token’s smart contract, that burns a specific amount of the token from each transaction. This type of token model is typically simpler to design, which means that many new projects will opt in towards using this model for their tokenomics. This is due to the fact that the deflationary token model makes it a lot easier to increase the token’s value over time due to the fact that the supply can only decrease over time.

How To Evaluate Tokenomics Properly

Studying the tokenomics surrounding cryptocurrency projects can play an integral role in your analysis, especially throughout the early stages when you are gearing towards learning as much about blockchain technology as possible.

A detailed, as well as a robust tokenomics whitepaper can break or make a project’s future. This means that you never want to invest in a project that has poor tokenomics. However, after all of the aforementioned information, you might be wondering how you can evaluate tokenomics properly.

To do this, here are some key steps that you need to make in order to make the best possible decision:

- Check the funding goal surrounding the project

- Take an in-depth look at the overall allocation details

- Figure out what the vesting schedule of a project looks like

- Evaluate the overall purpose of the token

- Conduct an in-depth analysis of what the goals surrounding the project actually are

- Watch this video for additional tips on project evaluation

Need Some Help with your Tokenomics?

Remember that It can initially be difficult to truly understand how tokenomics works, especially throughout the span of a single day, week, or even month. However, when you put in the time, commitment and effort, you will undoubtedly get familiar with tokenomics and can evaluate all future projects you decide to invest in with ease.

For the time being, however, if you do indeed require some assistance when it comes to figuring out tokenomics, you can utilize the service on offer by ScaleSwap, which can help crypto startups design tokenomics through the advisory incubation and acceleration services.

When it comes to launching a token within the crypto sphere, any project would want a reliable and professional partner, and this is where Scaleswap fits within this picture. The team behind Scaleswap can provide your project with solid and practical advice that can pave the way to a successful launch. From the strategy surrounding marketing to economics and overall technical assistance, Scaleswap can aid you in covering all bases when launching a new project.

Scalescore

Scalescore