Getting into crypto investing and interacting with exchanges can seem like a daunting task at first. In this ever-evolving space, it is important to understand the fundamentals and equip yourself with the tools and knowledge required to find the best exchange for your needs.

What Is a Crypto Exchange and How Does It Work?

Cryptocurrency exchanges are digital marketplaces where people can buy and trade crypto assets. In an ideal world, one would be able to buy crypto directly from the bank or through an investment firm. Currently, however, you will need to resort to exchanges if you would like to get your hands on the latest and greatest coin. Usually, this involves opening an account and funding it with traditional fiat money (think USD, EUR, CAD, GBP, etc.). Modern exchanges allow for multiple payment methods (e.g. credit or debit cards, or direct wire transfer) to top up your account and start trading.

There are several different types of crypto exchanges which we will explore further below in more detail. Unlike traditional exchanges that have predetermined trading hours, crypto exchanges are usually active 24 hours a day, 7 days a week.

To open an account with an exchange you are likely to go through an onboarding process that requires some personal information (name, address, etc.). Once your account is open you have the option to add funds to your account and start investing. If you navigate to the trading section of the platform you will be able to see multiple trading pairs – some are fiat-crypto, others are crypto-crypto. This is also where you can see the prices of different coins.

It is important to note that exchanges don’t set the prices. They are determined by the market and normally track coin prices in real-time. This means you will be able to purchase crypto at the current market rate. Naturally, exchanges look to make some profit on your trades so you can expect to be charged certain fees for trading and/or for depositing funds on the platform. We will revisit this point when we look at exchange fees.

An example of a simple trade that you can make is to purchase a cryptocurrency such as Ether (ETH) using your fiat money. Let’s assume that you are looking at the ETH/USD pair and you would like to place an order to buy some ETH. This means that you are parting with some (or all) of your USD in your account on the exchange, and you are buying ETH.

The two most common types of orders on an exchange are market orders and limit orders. With a market order, you are agreeing to purchase the coin immediately, but the price is not guaranteed. This means that if there is a sudden movement in the coin’s price you can end up paying more than the last traded price. This is where limit orders come in handy. Using a limit order, you can enter a specific price that you are willing to buy the coin for and it will only be executed when the price hits this mark or goes lower. The same principles apply to selling.

If you have gotten this far and made your first trade – congrats, you are now a proud cryptocurrency owner! At this stage, you can either keep your coins on the exchange, trade them for other coins, back to fiat currency, or you can move your coins to your personal crypto wallet. If you go the latter route, or if you send your fiat money back to your bank account you can encounter a withdrawal fee. We will discuss this when we look at exchange fees.

Different Types of Crypto Exchanges

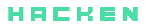

Crypto exchanges fall into two main categories – centralized and decentralized. Each type of exchange has its advantages and drawbacks, and it is important to understand these before you embark on your crypto trading journey.

Centralized Exchanges

Centralized exchanges, or CEXes, are the traditional and best-known type of exchange in the crypto space. They act as third parties facilitating trades between buyers and sellers. Examples include Coinbase, Binance, FTX, Kraken, etc.

These are governed centrally by a company and offer both crypto-to-crypto and fiat-to-crypto trading. Their platforms are normally very easy to use and offer a great UI and UX experience along with analytical tools to help your trading. Both web and mobile versions are usually available for users. Trading volume and liquidity are normally very high so you can expect smaller spreads (the difference between the buy and sell price) and quick execution of your trades.

CEXes also offer various trading pairs, dedicated customer support, and some additional services like staking (earning rewards for holding certain cryptocurrencies) and saving opportunities. Being very well funded, CEXes provide an additional layer of security and reliability when it comes to trading by facilitating transactions through a developed, centralized platform.

Speaking of platforms, most CEXes are accessible through a smartphone via their mobile apps if you are looking to trade on the go. Multiple deposit and withdrawal methods are available and buying your favorite coin can be as easy as a couple of clicks.

On the flip side, since CEXes are operated by companies that are responsible for the funds of their customers and large exchanges normally hold billions of dollars’ worth of crypto, they can be a target for hackers and theft. There have been examples in the past of such exploits leading to large losses for users.

Unlike holding your coins in your private wallet, keeping them on the exchange platform does not represent true ownership since users don’t own the private keys (think password) for these coins – they are technically owned by the CEX.

Another drawback of CEXes is that they often charge higher transaction fees compared to their decentralized counterparts and these can quickly add up if you do a lot of trading. We will look at the most common fees charged by exchanges separately.

Since CEXes are centralized and regulated entities, users are also required to go through some form of KYC (Know Your Customer) process. Despite stringent security features, some people are less inclined to share their personal information online hence why they prefer the anonymity of decentralized exchanges.

To use a CEX, you simply need to create an account, fund it, and start trading. In fact, the example we laid out above of buying Ether with your fiat currency is an example of a typical trade on a centralized exchange. Major CEXes offer comprehensive guides on how to start trading and if you ever feel lost you can always rely on the dedicated customer support team to help out.

Decentralized Exchanges

Decentralized exchanges (DEXes) seek to cut out the middleman and allow users to trade in a peer-to-peer manner with no need for an intermediary. Some of the most popular DEXes include Quickswap, Uniswap, and Sushiswap.

Unlike centralized exchanges, DEXes don’t allow swapping between fiat currencies and crypto – instead, users trade cryptocurrency tokens for other crypto assets. This is usually facilitated by smart contracts and “liquidity pools” where investors can lock funds in exchange for interest thereby providing liquidity for other users to execute trades.

One of the implications of this is that transactions on a DEX are settled directly on the blockchain whereas transactions on a CEX are recorded in their internal database. An inherent benefit of this is that hacking risks are greatly reduced since any trades on the DEX are stored in the traders’ personal wallets.

Since there is no central authority, counterparty risk (the likelihood that one of the involved parties in a trade will default) is also minimal. This is not the case with centralized exchanges – if the exchange defaults, you risk losing your holdings.

DEXes are a great way to invest in a hot new token in its infancy. There is virtually a limitless range of tokens ranging from well-known coins to completely random tokens. By the way, one of the best ways to purchase our very own SCA token is through Quickswap – a very popular DEX on the Polygon network.

Some users also prefer DEXes for their anonymity. There is no personal information required to trade on most DEXes. Decentralized exchanges are also increasingly popular in developing economies where the banking infrastructure might not be as developed, and people prefer to use crypto instead of fiat for their trading purposes.

DEXes are not without their drawbacks, however. If you are relatively new to crypto, they can seem less intuitive and harder to use as they are not as polished as some of the popular CEXes.

The lack of fiat to crypto trading also means that you won’t be able to swap your cash for your coin of choice directly. Investing in a DEX usually involves exchanging your money for a cryptocurrency such as a stablecoin (USDC, USDT, etc.) on a centralized platform and then transferring the funds to a DEX so that you can trade.

Given that decentralized exchanges are not regulated this also means that some of the coins available on the platform might not be scrutinized to the extent that they would be on a CEX. This is a risk that the trader has to be comfortable with before investing in a DEX.

Additionally, some risks are inherent to DEXes – smart contract risk for instance is something that you wouldn’t have to deal with on a CEX. Smart contracts are software programs that can contain bugs or be exploited by malicious actors. Decentralized exchanges often have bug bounties in place to discover and resolve bugs before an exploit happens, but it is important to be aware of these risks before parting with your hard-earned money.

Some of the perks available to CEX users are not available to DEX enthusiasts. You can expect much less handholding and interacting with the interface is not always easy. There is no dedicated customer support available to help and doing some prior research on how the specific DEX operates is recommended.

Trading on a DEX usually involves connecting to the platform with a crypto wallet such as Metamask. You will need to fund your wallet with a token available on the exchange which can then be used to swap for other crypto tokens.

Revisiting our example above, if you want to buy ETH you can swap the funds you have available in your wallet for ETH likely incurring a swap fee for the transaction as well as a gas fee. We will look at exchange fees next.

Crypto Exchange Fees

There are various fees that an exchange user needs to be aware of before they start trading. We will look at the most common fees associated with both CEXes and DEXes so that you are well equipped to dive into crypto investing.

Deposit Fees

Some centralized exchanges charge a fee for topping up your account. Normally, depositing money straight from your bank account is free of charge but credit or debit card transfers can incur anywhere between a 2% – 5% fee.

Trading Fees

Trading fees come in different shapes and sizes. The simplest form of a trading fee is the flat fee. This is where you are charged a fixed amount for a trade regardless of its size. There are exceptions and certain CEXes charge a smaller flat fee for trades below a specific threshold (e.g. $10) and a higher fee for larger trades.

Percentage fees are another common type of trading fee. This type of fee structure is what most of the popular centralized exchanges use. Typically, the percentage fee varies depending on the 30-day volume of trades that you have accumulated. As you can imagine, the higher your trading volume is the lower the percentage fee you are charged with would be.

For example, if you have placed orders over a 30-day period amounting to $20,000 you will incur a 0.20% fee for every trade that you place. If you go above this threshold your fees can reduce to 0.15%. The fee is paid in the currency that you are selling (also known as the quote currency). To go back to our simple ETH trade, if you buy ETH using U.S. Dollars you will be charged a fee in USD for this trade.

Fees can also be “hidden” in the spread. The spread in this context refers to the gap between the buy price (the bid) and the sell price (the ask) of a currency.

Imagine if 1 ETH is worth $5000 and at most exchanges, you can buy and sell the coin for $5000 incurring some percentage fee for the trade. Other exchanges prefer to artificially increase the spread so that the buy price of ETH is $5100, and the sell price is $4900 – this means that the spread is $200 and you are essentially getting less ETH for your dollar.

This is an extreme example, but it is worth paying attention to the bid and ask price to make sure you are getting a good deal. There are tools you can refer to such as CoinMarketCap and CoinGecko to find the best price for the coin you are interested in.

The fees we looked at above are typical for CEXes. If you are using a DEX, the fee structure is totally different. Since there are no fiat to crypto trades on a DEX, you will first need to buy crypto on a centralized exchange and then transfer your coins to the DEX. When moving funds from a CEX you are likely to incur a withdrawal fee which we will look at next. Once your coins arrive in your crypto wallet and you connect it to the DEX you are ready to start trading. There are two DEX-specific fees that you need to be wary of.

The first is called the swap fee and is essentially used to incentivize liquidity providers to facilitate trades on the DEX. The fee is usually around 0.2% to 0.3% depending on the platform. You pay this fee every time you swap one crypto for another.

Another DEX-specific fee and one that you need to pay particular attention to is the gas fee. Gas fees are payments made by users to compensate for the computing energy required to process and/or validate transactions on the blockchain. Each transaction you make on a DEX incurs a gas fee which is paid in the native token of the network.

If you are using a DEX on the Ethereum network, you will pay gas fees in ETH. Gas fees are notoriously large on the Ethereum network but are almost negligible on other networks like Polygon.

Withdrawal Fees

Withdrawal fees are the final area to consider when talking about exchange fees. If you are using a CEX, you’re given the choice to convert your crypto to fiat, and withdraw that fiat to a bank or financial institution. You are also provided with the option to move your cryptocurrencies to another address.

For a fiat withdrawal, you can expect to pay either a fixed fee or a fee based on a percentage that varies according to the size of the withdrawal. If you want to transfer funds to a non-custodial wallet or another platform, you normally pay a fixed fee denominated in the cryptocurrency that you are withdrawing. Crypto withdrawal fees vary across tokens and networks, and it is best to refer to the withdrawal fee section of your CEX to understand the specific cost.

There are no withdrawal fees associated with DEXes. In case you wish to transfer tokens from a self-custody wallet to a centralized exchange in order to swap back to fiat money you will only pay a gas fee for this transaction.

How to Choose a Crypto Exchange

By now you are familiar with what an exchange is, how they function, the various types, and the common fees you might encounter. You are probably thinking this is all well and good but how do I choose which exchange to use? We will now look at some key considerations to help with your decision.

Accessibility

Regardless of where you are in the world, consider which options are available in your country. You should have no trouble finding details on the geographical restrictions (as well as factors such as the types of currencies accepted) by visiting the website and reading its terms of service.

Security

Crypto is not backed or regulated by any central authority and the assets you hold might not be protected the same way as money in your bank or in traditional investments. Picking a secure platform is very important and some features you might want to look for are insurance policies in case of fraud or hacking or the availability of two-factor authentication systems.

Liquidity

A sufficient amount of trading volume is necessary to ensure you can cash out of your assets should you choose to do so. Normally the more reputable exchanges have the best liquidity for the assets listed. Crypto price fluctuations can be volatile and if you trust an exchange that doesn’t have adequate liquidity, you can end up paying more than you should. Sites such as CoinMarketCap work to track the volume of trading for numerous exchanges in operation and can be useful when choosing an exchange.

Coins offered

Not all coins are available on every exchange. Popular coins like Bitcoin or ETH are most likely to be available in any exchange but if you are interested in a less popular coin you will need to do some shopping around.

Fees

Fees vary across exchanges, and it is wise to do your research before investing to understand what you are getting into. Sometimes higher fees are justified for the sake of increased convenience, accessibility or security, but you want to make sure you are not paying more than you have to.

Educational tools

The opportunity to learn more about different coins, blockchain technology, and trading, in general, should be a priority for crypto beginners. Some exchanges have very comprehensive guides on these topics and others even offer rewards for watching videos and completing crypto-related quizzes. It is worth digging around the exchange’s website to see what they have available in terms of education.

The Best Centralized Crypto Exchanges

This wouldn’t be a complete guide on cryptocurrency exchanges if we don’t go over the main players and lay out the pros and cons of each exchange. This should help you make an informed decision and jump-start your crypto investing journey.

Note that this list is not in any particular order.

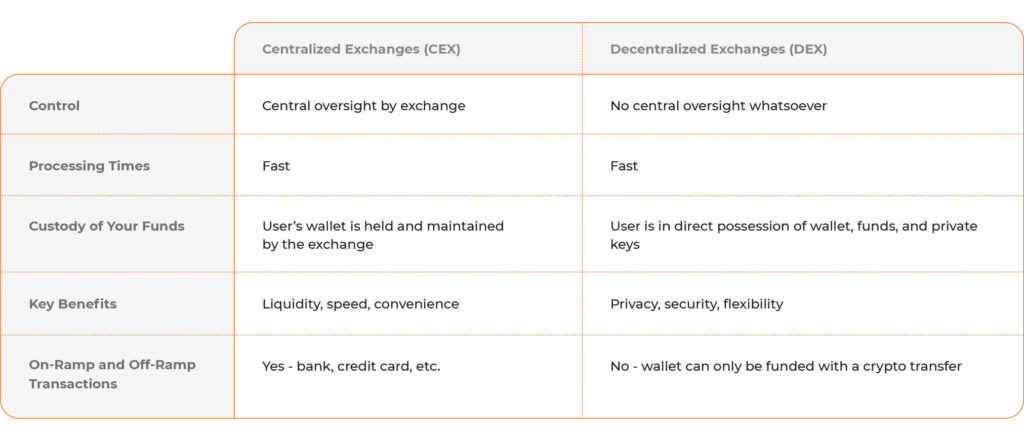

- Binance

Binance is an exchange based in Malta and is one of the most popular crypto exchanges. It is available to US residents and boasts very attractive trading fees of 0.1% per trade. You also have the option to stake your coins earning anywhere between 0.5% – 10%. The exchange provides users with insurance in case funds are stolen and with two-factor authentication for added security.

Pros

- Large variety of cryptocurrencies

- Advanced trading charts

- Low fees

Cons

- Not available in all US states

- Not very beginner-friendly

- Coinbase

Coinbase is another extremely popular exchange among crypto enthusiasts and for good reasons. The platform boasts over 30 million users globally across more than 100 countries. It is very user-friendly and offers insurance for lost funds. Some of the other account features include staking rewards and mobile apps for iOS and Android phones. There are also crypto rewards for watching educational videos.

Pros

- Easy to use

- Very high liquidity

- Large variety of cryptocurrencies

Cons

- Higher than average fees

- Limited payment options

- Kraken

Kraken is a very reputable CEX based in the US. It caters to beginners and experienced investors alike and offers very low trading fees. It provides strong cybersecurity and a large variety of crypto tokens available to trade. Users can choose a regular or a “pro” account with the latter offering lower fees and advanced charting tools. There is no premium for opting for a pro account.

Pros

- Great security features

- Numerous payment options

- Very low fees

Cons

- Slow KYC process

- Crypto.com

Crypto.com is an exchange that has been gaining popularity as of late. Based in Hong Kong, the CEX offers very low fees and very attractive crypto staking options with an interest of up to 12%. Users are also given the option to purchase a Crypto.com debit card that provides enhanced staking rates and cashback in the form of the native CRO token. There are also great referral and signing bonuses available to new investors.

Pros

- Very low fees

- Large coin collection

- Great bonus systems

Cons

- Slow customer service

- Complicated app system

- Gemini

Gemini is a US-based exchange that prides itself on its strong security features and fund insurance policies. It offers slightly higher trading fees than average but makes up for this with an easy-to-use interface, great liquidity, and up to 10 free crypto withdrawals per month.

Pros

- Strong security

- Easy to use

- No deposit fees

- Free withdrawals

Cons

- Only available in limited countries

- Higher than average trading fees

- FTX

FTX is an interesting exchange in that on top of regular crypto trading it also offers an NFT marketplace and provides an avenue for crypto derivatives trading. It has low fees and over 60 crypto assets for trading. It is regulated in the US and has strong security features including two-factor authentication.

Pros

- Derivatives markets offered

- Low trading fees

- Crypto savings accounts available

Cons

- Potentially overwhelming for beginners

The Best Decentralized Crypto Exchanges

We have so far looked at some of the most popular CEXes but it is also worth discussing some of the main DEXes available to crypto investors.

- Quickswap

Quickswap is the leading DEX built on the Polygon network and allows for peer-to-peer trading, in a permissionless fashion, via liquidity pools. It features standard swap fees for trading between crypto pairs but very low gas fees. It has the second largest total value locked on the Polygon network just behind AAVE with over $750 million in liquidity.

It has a very easy-to-use interface and has hundreds of coins available for trading. Quickswap is also the primary place for investors to buy our own SCA tokens!

Pros

- Ease of use

- Low gas fees

- The main marketplace for SCA tokens

Cons

- Limited liquidity mining options

- Uniswap

Uniswap is one of the original decentralized exchanges on the market and is a pioneer in the DeFi space. It is built on the Ethereum network and has over $7 billion in TVL. There are multiple incentives for providing liquidity and a very large number of tokens available. Being on the Ethereum network does mean that gas fees can be very high.

Pros

- Great incentives for providing liquidity

- Large token selection

- Battle-tested

Cons

- High gas fees

- Not very beginner friendly

Other Most Popular DEXs by Blockchain Network:

- Binance Smart Chain: PancakeSwap

- Fantom Network: SpookySwap

- Solana: Raydium

- Avalanche: TraderJoe

- Cardano: SundaeSwap

- Multi-Chain: Curve

- Multi-Chain: SushiSwap

Scalescore

Scalescore