A new method of investing in exciting crypto startups is on the rise, and it could become the de facto mechanism for projects to fund their development. Initial DEX Offerings (IDO for short) have a lot of potential, and offer a much better means for the average person to participate in new crypto projects compared to previous methods. We will discuss the different methods of raising funds, advantages, disadvantages, and why IDOs are quickly becoming the future of decentralized fundraising.

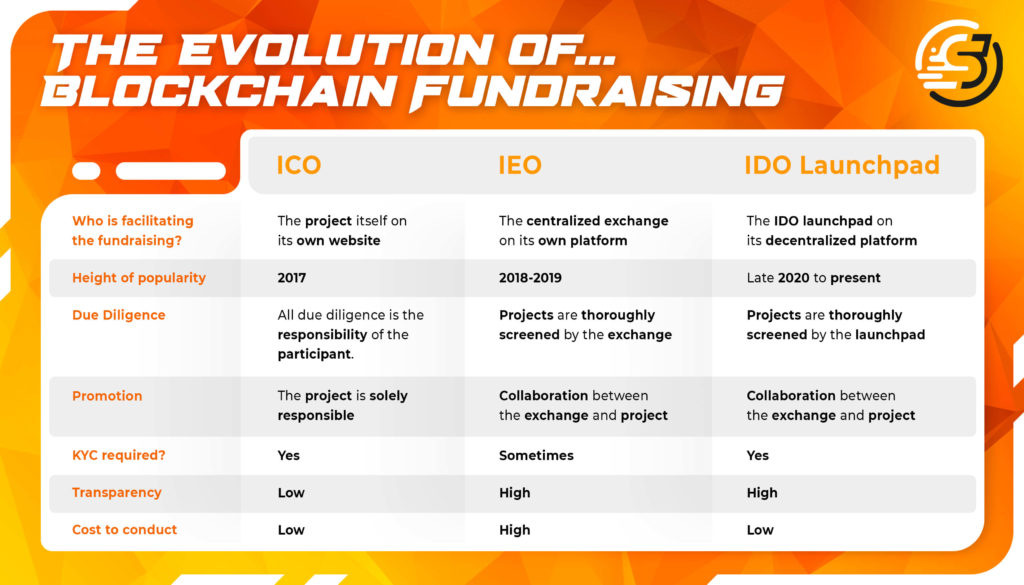

IDO vs IEO vs ICO: A Complete Comparison

One of the most important steps for an innovative startup is fundraising. Fundraising allows the founders to secure capital, develop their product, and grow significantly faster compared to a project that doesn’t raise money.

There are many ways a project can raise money, especially a crypto project. The most traditional method outside of the crypto space is an IPO, or initial public offering. In short, the company offers shares, or equity in the company, in exchange for capital. While this is an effective way to fundraise, many early startups are hesitant to take on additional partners and give up too much control. Luckily, crypto projects have a number of alternative ways to raise funds and bootstrap growth while retaining optionality: Initial Coin Offerings (ICO), Initial Exchange Offerings (IEO), and the most promising method, Initial DEX Offerings (IDO).

What Is An ICO?

An ICO was the first and most popular form of fundraising for projects in the crypto space. As previously stated, projects don’t want to give up equity in their project. Instead, the blockchain-based startup offers tokens, which typically have built-in utility or access to the project’s platform or service. Early investors purchase these tokens in the hopes that the company grows and succeeds, in which the price of their token increases as well.

How does an investor know which ICO to invest in? When the ICO is launched, the details about the project’s mission, its use case, and the timeline are also released in a document called a whitepaper. This is how the company summarizes what it is about, as well as marketing its value so it can have a successful ICO

There are three main paths an ICO can take. The first is having a fixed supply and fixed price. The amount of coins or tokens offered doesn’t change, nor does the price set per token. This is typically done when a project has a specific goal in mind. The next way is still having a fixed supply, but allowing for a dynamic range in price, where funding determines the overall cost per coin or token. The last way is to establish a fixed price with the supply remaining dynamic, so funding ultimately decides the supply.

Advantages

- Ease – Both for the token issuer and investor, the ease of participating in an ICO makes it attractive for all types of investors and generally reaches a larger audience than an IPO.

- No loss in Equity – The project team is not required to give up any equity in their idea to get funding, which is often essential for startups in their early stages of development.

- Incentivised community – Issuing tokens incentivizes the community to advocate and support their project; everyone has a vested interest in seeing the project succeed.

Disadvantages

- No guarantees or protections – ICOs are not regulated, so there are minimal to no protections for investors in the event of a scam or technical fault.

- Legal Issues – Many countries like China, France, Russia, and Thailand have either heavily restricted or outright banned ICOs. In the US, the SEC is cracking down on ICOs as they can be viewed as securities and thus subject to various US laws. The uncertain future of ICOs makes it unappealing to investors and startups wanting to raise capital via an ICO.

- High risk of scams- Due to its unregulated nature, ICOs have a high potential for scams and places all of the risk on the investor.

- Not much transparency between customer and token issuer – Besides what the token issuer and project state in their whitepaper, there isn’t much transparency or assurances in the ICO process.

The ICO model is far from a perfect system. In fact, ICOs are no longer used to fundraise crypto projects because of the overwhelming disadvantages, particularly the high risk of scams.

What Is An IEO?

The eventual fall of the ICO led to the rise of the IEO. An IEO is similar to an ICO, but with one crucial difference: An exchange facilitates the token sale. The exchange vets the crypto project applying for an IEO; it looks at the whitepaper, the team, the tokenomics, and many other checks to verify the project is legitimate.

Because of this, those applying for an IEO are typically more developed and have a minimum viable product (MVP) to market to investors. In short, the exchange serves as a middleman between investor and token issuer, mitigating risk that would be present in an IC

Advantages

- Vetted project – Because an exchange facilitates the IEO, it doesn’t want scams on its platform. Thus, each project that applies for an IEO is thoroughly vetted. This gives investors some security and piece of mind when investing in a project.

- KYC/AML Measures – Know Your Customer and Anti-Money Laundering measures also add security to both parties unlike an ICO.

- Seamless – Typically, the user experience is much more seamless in an IEO as the exchange facilitates the transaction and marketing.

Disadvantages

- Centralized – Perhaps the biggest advantage of blockchain technology is its decentralized nature, and an IEO is the opposite of that. Many crypto investors and enthusiasts want the benefits of decentralization such as transparency and being anonymous.

- Only available to exchange users – To participate in an IEO, investors must become users on that particular exchange. This may limit the audience of the project and limit fundraising.

- Fees – Because the exchange expends resources and time on the vetting process, projects typically must pay steep fees in order to launch an IEO. This was simply not a viable option for most startups.

The Rise Of Initial DEX Offering (IDO)

One of the most recent and promising ways for projects to get funding is via an IDO. An IDO originated as a token offering done through a decentralized exchange. There is no middleman involved like in an IEO, offering peer to peer transactions that increase transparency while minimizing risk. The IDO model was developed to avoid the drawbacks of both ICOs and IEOs, leveraging decentralized blockchain technology to achieve superior useability and security.

How Does An IDO Work?

Initially, IDOs used decentralized exchanges (DEX) and smart contracts to facilitate the transfer of tokens and funds between parties. They’ve since mostly migrated to being held on specialized platforms called IDO launchpads. These launchpads help mitigate the risk of investors with large crypto wallets (also known as whales) buying a large majority of the tokens in an IDO.

On an IDO launchpad, the transfer of capital for tokens is done quickly and seamlessly compared to ICOs and IEOs. As a result, there is no delay for funds and investors usually get instant liquidity. In addition, the vetting process for an IDO on a launchpad is done collectively by the team and community rather than a centralized exchange, which benefits investors and increases security.

What Are The Advantages of An IDO?

- Decentralized – IDOs utilize blockchain technology to facilitate the IDO transaction, making it much more transparent and secure than ICOs and IEOs.

- Vetted projects – IDOs hosted on a DEX are still vetted, albeit by the community, not just the exchange. IDOs hosted on an IDO launchpad are usually thoroughly vetted by the team and/or a special counsel, as well as the community.

- No fees – IDOs avoid the high fees that are associated with launching an IEO and listing on an exchange, so it’s cheaper and easier for startups to launch an IDO.

- Safer – While there’s no such thing as no risk, IDOs are at much lower risk of being hacked because they don’t store funds like centralized exchanges do.

- Immediately listed – An advantage of IDO is that the transaction is instant, so both parties have access to their funds/tokens immediately. However, for IDO members, there are often vesting schedules attached to the token being acquired so you’ll need to make sure you read the terms before participating.

What Are The Disddvantages of An IDO?

- No stable price – While IDO offers instant accessibility to investors, this accessibility (particularly shortly after listing) can make the price of the token extremely volatile.

- Market Manipulation – When new tokens are able to be traded, there is always the risk of “pump and dumps” where the value of the token is artificially inflated and then a large amount of those tokens are sold off. That’s why it’s important to choose an IDO or an IDO platform carefully.

What is the Future of The IDO Model?

IDO has a lot of advantages over ICO and IEO models, and it leverages the most out of blockchain technology. However, centralized exchanges are more ubiquitous, and much more user friendly to the general public and novice crypto traders. For IDO to transition to a mainstream fundraising mechanism, a couple things need to happen. First, IDO needs to be user friendly and accessible. As cryptocurrency and blockchain technology become more commonplace, public awareness will grow. This will help new investors enter the space and participate in IDOs, without the need for extensive crypto knowledge.

Fortunately, the ascent of the IDO launchpad helps make IDOs accessible and relatively easy to use. An IDO launchpad is a specialized platform for startups to launch from (hence the name) and crowdsource their funding. Launchpads are more user friendly, have their own community, usually accompanied by their own utility token as well. Startups are vetted through the launchpad, and then the launchpad community gets the opportunity to invest in new crypto projects.

Scaleswap IDO Launchpad

While IDO launchpads are revolutionizing decentralized fundraising and already being incorporated into almost every new project’s go-to-market strategy, there are still some kinks to work out when it comes to fairness and barriers to entry for newcomers.

Currently, this selection process on most IDO launchpads for deciding who is chosen to participate in an IDO is either luck-based or purely budget-driven – with some of the top launchpads requiring users to hold tens of thousands of dollars worth of tokens to achieve guaranteed allocation in an IDO launching on their platform. This is simply not fair to the average DeFi user,” said Ralf P. Gerteis, CEO of Scaleswap.

Scaleswap aims to eliminate these barriers and increase fairness and transparency through a loyalty based scoring system for its users. ScaleSCORE is a multidimensional scoring system that empowers users based on their commitment, with the lowest possible impact on actual buying power. By valuing community over budget, Scaleswap is providing a way for anyone to increase their score and participate in IDOs, regardless of their starting budget.

This also has a positive effect for the projects launching on the platform because they can tap into this carefully cultivated community to bootstrap growth and strengthen their launch strategy.

How To Buy Tokens Through an IDO Launchpad

So you know all about IDOs, but how do you participate? The majority of IDOs are now hosted on IDO launchpads, not decentralized exchanges. So, typically you must become “whitelisted” by a launchpad, which means chosen to engage in new IDOs. Each launchpad has its own guidelines and paths to get whitelisted.

While some launchpads use purely financial metrics to decide participation, others like Scaleswap’s ScaleSCORE take loyalty and involvement into consideration. Also, those who hold the launchpad’s utility token typically get more entries to participate. Once you’re whitelisted and gone through KYC, congrats! You can now buy tokens for that IDO, and the launchpad will likely send you the information you need to prepare.

Conclusion

How crypto projects fundraise money has evolved significantly over the past few years. Each step of the way saw increased security for investors, minimized risk to scams, and an overall better experience for all parties involved. The evolution of decentralized fundraising via IDOs led to the creation of IDO launchpads. Currently they offer a safe, easy, and seamless way to participate in IDOs. The future of cryptocurrency as a whole is away from centralization and towards decentralization, which IDO launchpads embody and promote. This is why IDOs and IDO launchpads are the future of fundraising.

Scalescore

Scalescore