Nowadays staking crypto is the most hyped and accessible way to earn passive income.

As the cryptocurrency ecosystem evolves with the speed of light, new opportunities for crypto staking are constantly fighting for attention.

And that’s not a surprise since the more people stake in the particular blockchain ecosystem, the more scalable and secure it becomes.

Why is staking and what is the technology behind it? In the next 2-3 minutes you’ll learn everything necessary to take advantage of the various staking opportunities!

How Does Crypto Staking Work?

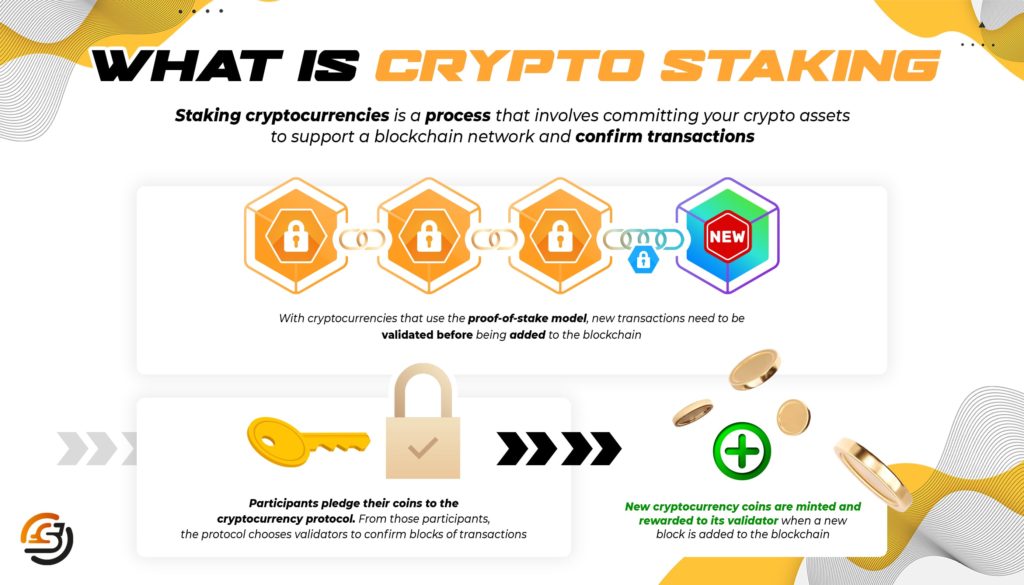

In simple terms, to stake your crypto means to lock a certain crypto asset and earn passive income (yield) in return. There are various reasons a project might offer staking rewards, but staking originated as a method to incentivize users to participate in supporting a decentralized blockchain network.

After you delegate your crypto to the blockchain protocol of your choice, those funds act as your stake and become part of the validation process of the information stored on each block. As you probably know, the blockchain is a chain of blocks that store information regarding every transaction that takes place.

Your staked crypto confirms other transactions in the same protocol and the more crypto you have staked, usually means the higher the chance that your staked amount will be rewarded for validating a block.

After a new block is added to the chain, a new specified amount of crypto is minted and part of those rewards are transferred to your staking address as payment for your contribution.

However, this is possible only on blockchain networks that support the proof of stake model.

What is Proof-of-Stake?

Let’s first discuss the predecessor of proof of stake which is called proof of work. The older and already proven cryptocurrencies like Bitcoin and Ethereum still use the proof of work method since for them it’s much harder to fork to a proof of stake mechanism due to the sheer size of their established networks. Ethereum is actually undergoing a lengthy adoption of the proof of stake model.

The proof of work model has arguably become outdated due to the amount of work and resources required to sustain it.

In comparison, the proof of stake model not only consumes much less energy but also is more scalable due to the significantly lower fees and faster transactions.

Another big advantage of the proof of stake system is that there are various consensus methods with a fairer selection of validators as opposed to proof of work. This helps the ecosystems build communities with equal rights and profit opportunities similar to DAO networks.

Mining vs Staking

Mining and staking are completely different processes. The most significant difference is efficiency and cost-effectiveness.

The process of mining is happening in the proof of work consensus protocol where significant computing resources are required to “solve” blocks.

Every novice crypto miner has to buy a lot of expensive and hard-to-set-up equipment. On the other hand, staking only requires an initial investment in the blockchain protocol of your choice.

Mining to support a proof of work consensus may still have some advantages as POW networks can sometimes offer higher and nearly guaranteed returns. Even though staking in prominent protocols like Solana and Polygon will most likely provide you with fairly consistent expected returns, there is still a small chance that it doesn’t always go as expected.

So, if you are a tech geek who loves playing with gadgets and doesn’t get discouraged if things don’t work on the first (or 5th) try, then mining crypto might be quite adventurous and entertaining for you.

On the other hand, if you simply want to put your crypto assets to work with the minimal amount of effort necessary, then we suggest you stick to staking crypto.

Advantages of Staking

Crypto staking has revolutionized the entire blockchain industry so much that the Ethereum ecosystem is in the process of switching from proof of work to proof of stake. To date, it is by far the largest and most established ecosystem to make such a change.

This wouldn’t have been worth the trouble if there weren’t significant advantages for both the blockchain protocol and its community. Let’s explore them one by one.

- Completely passive income

If you want to stake crypto, the only work you have to do is buy the required crypto and put it into the staking pool so it can start yielding your rewards.

Of course, you have to do your research before putting in any funds, but if we exclude the research, there’s no extra effort to earn once your crypto is staked.

- Support the blockchain ecosystems you believe in

Without the people who have invested in the blockchain protocols, these networks simply would not exist.

If you believe in the technology of a protocol and its current and future impact on the world, staking crypto is one of the best ways you can show your support.

On top of that, you’re being rewarded, so it’s a solid win-win!

- You help the crypto industry switch to a more eco-friendly approach

As we mentioned, the proof of work consensus mechanism is harmful to nature due to its high electricity consumption.

That is why if more and more people choose to stake crypto, every blockchain protocol will be forced to switch to proof of stake.

What Can I Stake and How to Start?

The number of cryptocurrencies available for staking has increased drastically over the past few years. Let’s take a look at the most popular and trusted protocols for staking crypto.

Cardano

Staking Cardano (ADA) happens through its proof of stake mechanism named Ouroboros.

As with every established proof of stake network, Cardano also offers a calculator which you can use to forecast your approximate staking rewards.

At the time of writing this article, you can earn 5% APY on your Cardano staking.

Solana

This blockchain ecosystem has some significant differences in its technology. Solana’s developers have created an entirely new consensus method called proof of history (POH).

That by itself decreased its block time to 400 milliseconds which makes it around 15 times faster than other protocols like Ethereum or Solana. Just like Cardano, Solana also offers an approximate 5% annual return.

Polkadot

The unique selling proposition of Polkadot is its lack of supply limit. That enables the protocol to connect with other chains and put them into a single network which makes parallel transactions and exchanges of all kinds of data.

Currently, the returns you can expect from staking DOT are 10%.

There are also other cryptocurrencies available for staking like Ethereum, Terra, Tezos, and more. Make sure you consider all the risks involved in staking no matter how big of a believer you’re in a certain protocol.

Alternative Forms of Staking

There is another option for you that can potentially bring you even higher profits.

Let us introduce you to ScaleSCORE – our scoring system used to determine who can participate in the exclusive fundraising rounds of innovative crypto startups that are soon launching to the market.

ScaleSCORE doesn’t require you to entrust your tokens to a smart contract. You simply hold them in your own wallet and watch your score grow. With this new scoring system, Scaleswap aims to revolutionize the IDO landscape so more people like you can take advantage of the same early investment opportunities as established venture capitalists.

The Future of Crypto Staking

Many believe that staking will continue to play a crucial role in crypto’s future. After Ethereum’s recent update from 1.0 to 2.0, combined with growing environmental concerns around the globe, it is safe to say that the proof of stake consensus method will get consideration from every blockchain protocol in existence.

Play your cards smart and there’s a great chance that you’ll notice some exciting growth in your portfolio down the road. Patience is key!

Scalescore

Scalescore