The post What is Web 3.0? The Decentralized Internet of the Future Explained appeared first on Scaleswap.

]]>Numerous issues with the current web are becoming more apparent. Personal data infringement and the over-centralization of the information infrastructure by tech giants are some of the problems we face today. Web 3.0 has the potential to truly revolutionize the way we interact online and showcase how far advancements in artificial intelligence and blockchain have come.

There are pitfalls and hurdles that we, as part of the builders of this new frontier, need to overcome before we get there. That said, the first steps have already been taken with cryptocurrencies leading the way in innovation and adoption of new technology.

What is Web 3.0?

Web 3.0 is the term used to describe the evolution of the World Wide Web that initially took off in the 90s with the introduction of web browsers. The first generation was deemed to be Web 1.0 and later became Web 2.0 with the rise of platforms like Google and Facebook. Web 3.0 is an umbrella term that depicts a vision for the future of the internet where advanced technologies such as machine learning, decentralized ledgers, and democratic forms of governance are the fundamental building blocks of the web.

The advancements made in the field of artificial intelligence (AI) and the rise in popularity of cryptocurrencies and blockchain all pave the way towards an enhanced internet experience with greater user utility.

Originally, the term Web 3.0 was used interchangeably with the Semantic Web. The Semantic Web aimed to enhance the content of web pages and enable software to carry out various tasks for its users through a better understanding of human language. Current thinking has gone beyond this definition, however, and includes concepts such as interconnecting data in a decentralized manner which is a massive step forward compared to the current web generation where data is predominantly stored in centralized repositories.

The next generation of the web envisions programs understanding information both contextually and conceptually. This would mean that users can rely on more relevant data that is specific to their needs. Through decentralization, ownership and control are handed back to users who will be able to essentially govern the development of the web collectively.

Web 3.0 to a large extent is about moving away from centralized databases currently held by the big tech giants to a shared infrastructure where end-users have real control over their data and a democratic influence over the systems and services they use.

Web 3.0 – Cryptocurrency & Blockchain

The next iteration of the web will operate in a decentralized ecosystem. Decentralization sits at the core of cryptocurrency and blockchain so it can be assumed that there will be a strong connection between Web 3.0 and these technologies. Automations using smart contracts, enabling anything from small transactions to a house purchase, are likely to change how companies operate and lead to multiple optimizations in day-to-day life.

We are already witnessing a revolution in the world of investing with the proliferation of decentralized finance (DeFi) platforms and decentralized exchanges that remove banks and centralized institutions from the equation. Networks like Ethereum have already managed to attract over $100bn in liquidity across different protocols.

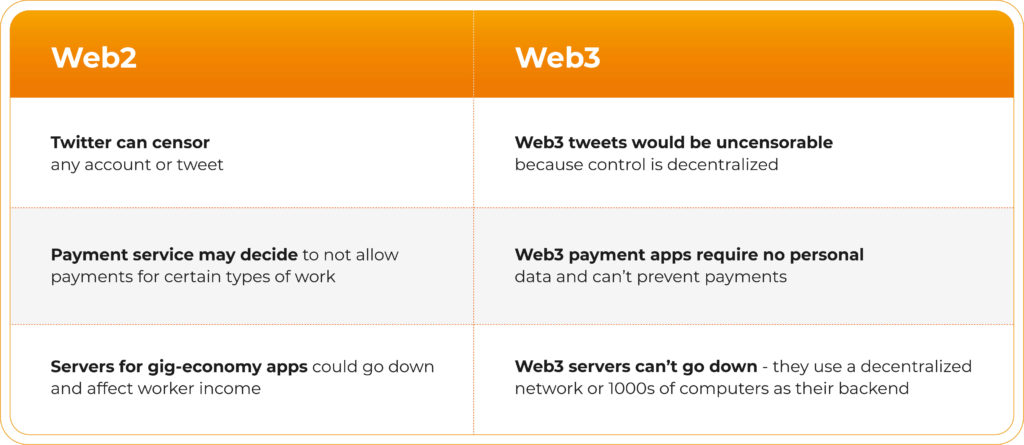

However, blockchain technology also has use cases beyond investing that can solve many of the issues that Web 2.0 faces today. One example of this is the risk of downtime of a centralized platform that can be caused by a variety of reasons. Decentralized applications (DApps) and Web 3.0 servers are more resilient as they are powered by tens of thousands of computers as opposed to one central hub. It is also expected that Web 3.0 will reduce the volume of DDoS attacks as bad actors will not have an easy time disrupting internet services as easily as they can now since there will no longer be single points of failure.

In an increasingly fast-paced and openly accessible digital world, blockchain technologies can be used to increase scale, speed, and privacy, serving as the backbone of the next generation of the web.

Evolution of the Web

The web has undergone significant changes and developments over the past few decades and it’s worth taking a quick look at how we got where we are today.

Web 1.0 (1989 – 2005)

Web 1.0 was the first iteration of the internet, often referred to as the Static Web. It offered access to limited information and did not provide users with lots of meaningful interaction. Search engines were a thing of the future, and it was difficult for users to find information reliably.

Web 2.0 (2005 – present)

The next iteration of the web, sometimes referred to as the Social Web introduced a lot of interactivity with the help of technologies such as HTML5 and Javascript. Platforms such as YouTube, Google, Wikipedia, and many more became prominent.

Social networks allowed for seamless interaction between users across the globe. Applications (both web and mobile) ranging from a simple calendar management tool to activating your vacuum cleaner remotely became essential tools in day-to-day life.

Web 3.0 (future)

The next step in the evolution of the web is poised to make the internet even more intelligent through the use of AI systems and technologies like blockchain. Content generation and decision-making processes are likely to involve both humans and machines. This should result in highly tailored content delivered straight to every web consumer. If we also consider the benefits of decentralization it is hard not to get excited about what’s to come.

Key Features of Web 3.0

Web 3.0 attempts to organize information in a more logical way than any Web 2.0 application. There are five main features that help define Web 3.0.

Semantic Web

The Semantic Web aims to enhance the online experience by allowing users to create, link, and share material through analysis based on the capacity to comprehend the meaning of words rather than just keywords or numbers. In other words, web apps will start understanding the human language better.

Artificial intelligence

Web 3.0 will be able to understand information in the same way people do by using the power of natural language processing. This should result in faster and more relevant search results. Although this technology has already seen use in Web 2.0 it is predominantly human-based and this allows for corrupt practices like manipulated ratings or inaccurate product assessments. To be effective, AI needs to learn how to distinguish between genuine and fake information.

Another interesting feature that AI can facilitate for Web 3.0 is the use of bots that serve users with certain needs. People will be able to purchase and configure bots for a whole range of tasks leading to the optimization of lots of everyday tasks.

3D Graphics / Metaverse

Websites and services in Web 3.0 are likely to feature three-dimensional designs. This includes but is not limited to museum guides, games, and e-commerce. The next generation of the web will likely blur the line between what is real and virtual creating a new level of immersion and a truly futuristic experience.

Ubiquity and connectivity

Ubiquity means having the ability to be everywhere at the same time. Web 3.0 makes the internet available to everyone, anywhere, and at any time even without the need for a computer or a smartphone. User experience is elevated to the next level of connection that takes advantage of all accessible data rather than just separate clusters.

Ultimately, data will be accessible by multiple applications, with every device being connected to the web and services being available everywhere.

What’s Wrong With the Current Web?

We have already briefly explored some of the disadvantages of the current web. One particular issue that is worth delving further into is that Web 2.0 has become increasingly centralized and controlled.

As the internet evolved from its infant state to what we have today, many companies took the liberty to remove the technical difficulties that made it hard for users to create content and interact online. This is, of course, a good thing practically speaking but it also comes with significant tradeoffs.

Photographers can seamlessly upload their photos to the web via services like Flickr and Instagram. Video content creators can rely on YouTube to share their work and tools like WordPress make writing blogs feel like a walk in the park. Social media platforms have also contributed to people getting online and interacting from virtually anywhere in the world.

However, network effects and low marginal costs have led to the internet becoming increasingly centralized and effectively governed by big tech. This limits the web’s potential and puts the future of the internet in the hands of the few. This can lead to issues related to censorship and constricting the payment options for some types of work to better suit the central authority.

Centralization vs Decentralization

One of the main perks of the decentralized Web 3.0 is that it strives towards openness and accessibility, lack of censorship, and increased privacy.

In terms of accessibility, this means not locking users into a particular service like Apple’s iCloud or Microsoft’s OneDrive. Censorship and privacy are of particular concern as social media companies look to profit from trading personal information and even collaborate with governments and other companies for monitoring purposes.

Centralized systems do have their advantages. The timely propagation of information is easily achieved as it is controlled by a central authority. Conflicting data is easily resolved since the source of truth is the central authority. Coordination between users is easy since it is handled by a central hub. On the flip side, however, the concentration of power in one source makes it a target for malicious actors. Censorship can also be applied by cutting off certain participants as deemed appropriate by the central authority. And of course, the central authority has an innate interest to fight against any change to the status quo.

Decentralization allows for anyone to participate in the network and the cost of participation is minimal. Censorship is difficult as there are many ways for information to propagate across the web. There is also no single point of failure, and the network continues to function even if one part of it is attacked.

This is not to say that there are no drawbacks to decentralized systems. Information could take longer to be broadcast between users as participants can be many edges away from each other. These systems are also more complex to implement and require more computational resources. Coordination can also be an issue as there is no central authority to have the final say and this can cause fracturing when there are disagreements on important decisions.

Web 3.0 Applications

Applications in Web 3.0 are still at their early stage of development, but we are already seeing some progress. Services provided by some of the big tech companies are already transitioning to the next generation of applications and are utilizing Web 3.0 technologies. In addition, the DeFi space is a great example of what Web 3.0 apps could look like in the future.

Wolfram Alpha

Wolfram Alpha is one of the major Web 3.0 apps in 2022 and is a product of Wolfram Research. It is a computational knowledge engine able to gather sufficient information from web databases to make it available for users through an elegant UI. Typing any kind of question in this app should provide an accurate answer efficiently.

Topics can range from mathematics, technology, science, as well as everyday issues. The major difference compared to services like Google is that the engine can better understand human language and is not based on keywords and popular searches. This is one of the big differences between Web 2.0 and Web 3.0.

Siri

Apple’s Siri is another good example of a Web 3.0-like service. It uses voice recognition software to provide accurate results each time you ask a question. Web 3.0 apps rely on machines being able to communicate with each other to provide meaningful information. AI and speech recognition are likely to be major elements in the next generation of the internet, helping users with performing complex and personalized tasks.

Sapien

Sapien is a unique example of a Web 3.0 service. It is a decentralized social network website powered by the Ethereum blockchain and is incredibly configurable. It also allows users to build their own apps without the need for payment or ads. Sapien enables participants to interact, share information, transact and form communities through a collection of self-sovereign tools.

DeFi

DeFi platforms are becoming increasingly popular and are likely to play an important role in the future of the internet. The connection between Web 3.0 and blockchain technologies is very clear and the DeFi space is rife with innovation and futuristic ideas that are bound to shape the next iteration of the web.

Here at ScaleSwap, we look to contribute to these developments by providing a decentralized multi-chain fundraising platform. By providing our community with fair access to exclusive early-stage IDO opportunities we increase awareness and open up the DeFi world to anyone who is looking to participate with and support an innovative project before it hits the public market.

In doing so we also encourage the growth and progress of new ideas by providing critical resources and funding to the builders of tomorrow.

Web 3.0 Limitations

It is hard not to be excited about the future of the web but it is important to understand some of the limitations and challenges that Web 3.0 faces.

The vision for Web 3.0 includes verifiable, trustless, and robust transfer of data across platforms. For the transition to Web 3.0 to work, people will need to start using and developing DApps. This can be challenging as a large portion of the user base is non-technical and might find it difficult to use these apps. To overcome this issue DApps will need to be simpler so that every user can easily interact with them.

Another potential drawback of Web 3.0 is that despite offering better security, the decentralized internet is still much slower than its centralized counterpart which can process an incredible number of requests at one time.

Scalability is another limitation that needs to be addressed for Web 3.0 to be successful. The way blockchain works is that every transaction must be processed by all nodes. This often leads to network congestion and can be a hindrance to the network’s ability to handle the apps of tomorrow. Solutions that address scaling and speed are paramount in achieving the vision for Web 3.0.

Decentralization can also carry significant legal and regulatory risks. Issues like cybercrime and misinformation are already difficult to police, and the lack of central control can compound this issue. A decentralized internet would also make regulation and enforcement difficult. Imagine if a specific site is hosted in numerous nations globally – which country’s laws would apply?

What Do Regulators Have To Say About Web 3.0?

It is not uncommon for technological revolutions to be met with fierce opposition from regulators. Cryptocurrency regulations are a good example as governments across the globe are struggling to adopt a uniform approach to this market. Web 3.0 will challenge old models of what constitutes a firm, a security, or even a transaction.

There have been roughly two responses to Web 3.0 developments from regulators. On the one hand, some governments are taking a more authoritarian approach in an attempt to capture new technology and eliminate private competition. Others seek to force next-generation innovations into compliance with existing legal structures which have little in common. Both stances are clearly not in the best interest of the openness and decentralization that Web 3.0 seeks to achieve.

Risk aversion is a common theme across regulators. The Securities and Exchange Commission (SEC) has already expressed a strong stance against cryptocurrencies with its ongoing legal battle against Ripple.

The SEC is not an outlier and other agencies have also sought to limit the potential of Web 3.0 including the Commodity Futures Trading Commission which labeled decentralized finance “Hobbesian” and put its legality into question.

Other regulators have taken a more laid-back approach discarding bureaucratic mindsets. An example is the Royal Melbourne Institute of Technology which has put forth suggestions to better embrace innovation. These include creating a new classification for Decentralized Autonomous Organizations (DAOs), treating stablecoins as ordinary currency without the need for special compliance, and creating safe harbors for innovation.

It is clear that regulators across the world will need to rethink their approach when it comes to the Web 3.0 revolution and we can only hope that governments will not stand in the way of achieving the new internet’s full potential.

The post What is Web 3.0? The Decentralized Internet of the Future Explained appeared first on Scaleswap.

]]>The post Crypto Slang Terms Every New Investor Needs to Learn appeared first on Scaleswap.

]]>Crypto Slang List 2022

- HODL

HODL is an acronym for “Hold On for Dear Life”. In the crypto community people ask many questions: Should I buy? Sell? Hold out? HODL is a term meaning hold, or do not sell. Especially in times of extreme price volatility or panic, a natural instinct is to sell. Hodling is a strategy for long-term investment to weather price volatility and wait for a better opportunity to sell. It is one of the most widely used crypto slang terms you will come across.

Example: “I am going to Hodl through this bear market”

- Diamond Hands & Paper Hands

Diamond hands is a term expressing high-risk tolerance. This term originates from Reddit and Twitter stock market slang and has made its way to crypto. If you have diamond hands, you typically HODL as well and don’t panic or sell quickly. In contrast, paper hands mean that you are susceptible to selling quickly. Someone with paper hands sells shortly after any negative news or dips in the market, having very little risk tolerance.

Example: “His diamond hands made him a lot of money hodling”

Example: “If you didn’t have paper hands, you would’ve been rich”

- FOMO

FOMO is another common acronym used in the crypto space, standing for “Fear Of Missing Out”. In cases where a crypto’s value is rising, investors don’t want to miss an opportunity to profit and feel an urge to invest before the price gets too high. Investors can also have FOMO on a new crypto project, not wanting to miss out on any possible gains.

Example: “When bitcoin was rising in price, I had FOMO and bought some before it was too late”

- FUD

FUD means fear, uncertainty, and doubt. It is a scheme to spread negative news, information, or stories in order to drop the coin’s price. People who do this are referred to as “fudders”.

Example: “The fud got to me, and I decided to sell before the price skyrocketed”

- Shitcoin

A Shitcoin is a term to say that a coin has no value or use. It is used commonly to degrade or attack a coin or warn others about the coin.

Example: “Why do you invest in shitcoins?”

- Ape

Ape in or Apes is used to describe investors who throw money at a coin or project without doing research. This commonly happens when an investor has FOMO and quickly invests.

Example: “This project took off so fast, all these apes are throwing money at it”

- BTD/BTFD

Buy The Dip or Buy The f*ucking Dip is a crypto and investing term. When the market value of a coin dips, buying the dip is a common strategy. In a bull market, it lets you get in at a better price before it continues climbing. In a bear market, buying the dip is a good strategy for long-term hodling.

Example: “It’s now or never to BTFD”

- Degen

Degen, or degenerate, is used to refer to someone who is a risk-taker in the crypto space. This could be buying at risky times or in risky projects.

Example: “This degen really bought all those shitcoins”

- GM

GM, or Good Morning, is not necessarily a crypto-specific term but is widely regarded as crypto slang. Used as a greeting, just make sure not to confuse it with other terms.

Example: “GM investors!”

- NGMI/WAGMI

NGMI means “Not Going to Make It”. It is slang used to express negativity towards a person or company. On the other hand, WAGMI (We Are All Going to Make It) is an affirmation that everything will turn out okay.

Example: “WAGMI, just have a little faith”

Example: “This project NGMI, it just doesn’t have the right development team”

- IYKYK

If You Know You Know, IYKYK is a term to express an inside joke or being coy with some information.

Example: “Wow, that was crazy #IYKYK”

- LFG

LFG means “Let’s F*cking Go” and expresses excitement over the news or just in general.

Example: “Big news is coming, LFG”

- Looks Rare

Looks Rare is a phrase that commonly refers to NFTs. If someone says “looks rare”, they are saying it might be rare and thus valuable.

Example: “That NFT looks rare”

- Probably Nothing / Few

Probably Nothing and “Few” are a way to say something is probably important ironically. It also can mean (ironically) that few people are aware of something.

Example: “Bitcoin just hit a new all-time high, probably nothing.”

- (3,3)

(3,3) is a meme whose meaning is somewhat obscure. A project named OlympusDAO used game theory to explain and organize its community operations. (3,3) references game theory and signifies that this is the optimal outcome for all parties. In this specific case, staking in OlympusDAO is (3,3). So when you see this, it means collectively we should all stake in OlympusDAO. Of course, (3,3) can be applied generally to mean we should all do what is best for everyone and look for an optimum outcome.

Example: “I staked in OlympusDAO, so you should too so we can (3,3)!”

- Shilling

A shill is a person that promotes and advertises a cryptocurrency for profit. They typically have a large social media presence and following.

Example: “This famous person is just a shill”

- Moonboys/Moonbois

Novices who overhype a coin are referred to as moonboys. They think they will get rich quickly once the coin they invest in “goes to the moon”

Example: “These moonboys are out of their mind with their expectations”

- Lambo

You may hear people say “When Lambo?”. They are asking when the price will increase or climb to a high price (so they can afford a lambo). They are typically only concerned about the price of the coin. This crypto slang term may also be thrown around ironically.

Example: “I just invested. When Lambo?”

- Wen/Wat

Wen/Wat are simplistic spellings of When and What; this is done usually to poke fun at people asking simplistic questions.

Example: “wen lambo?”

- Boomer

Boomer is a reference to the baby boomer generation. It is commonly used to describe something outdated or obsolete. It can be used to describe a person who is acting like a “boomer”, or a coin/technology that is outdated. For instance, Bitcoin is sometimes referred to as Boomercoin.

Example: “The people running this project are boomers”

- Wagecuck

A Wagecuck is someone who has a normal, 9-to-5 day job. This term is often used in a negative way, or in a joking manner. There are typically two types of people in the crypto space. First, you have “wagecucks” who have normal jobs and dabble in crypto part-time. Those who don’t have a normal job are in crypto full time, and their activity and investing are how they make a living. These people don’t have set hours and sometimes are their own bosses.

Example: “I hope I can stop wagecucking after I make some money”

- Pleb/Normie

Pleb or normie is just that: a normal person. Sometimes people new to the crypto space or don’t know much about crypto are referred to as plebs or normies. These terms can be used to put down or target those less knowledgeable in the crypto space. They can also be used to defend people who lack technical crypto knowledge.

Example: “These plebs don’t know what they are doing”

Example: “He’s just a normie, so give him a break”

- Fren

Fren is a term that means friend or friends. Usually used in a joking or meme-este way, fren is a way to say you enjoy a person or a group of people.

Example: “I love my frens in the NFT community”

- Ser

This is another common misspelling that is intentional. It means “Sir” and is used jokingly or to poke fun. It can also be used to point out that a conversation or situation does not have to be as formal as it is.

Example: “Excuse me ser”

- Gigabrain/Gigachad

Both gigabrain and gigachad are terms referring to someone’s high intelligence or presence in the crypto space. This is someone who is an expert or a large figure in the crypto space.

Example: “Investing at that time was a gigabrain move by him”

Example: “He’s a real gigachad, that’s why the project is doing well”

- Smol brain / Smooth brain

Smol brain/smooth brain (in contrast to giga brain) is saying that someone has low intelligence or a poor understanding of a subject.

Example: “That was a smooth brain move”

Example: “They have a smol brain when it comes to big picture thinking”

- Anon

Anon in its usual context means anonymous. Because most crypto users are anonymous, Anon is used to address the general user. An analogy would be how users of the social media platform Reddit are called Redditors.

Example: “Anon, What are we going to do?”

- -oooor

Among the many ways to put down or shame people/concepts in the crypto space, -oooor is a way to say a person doesn’t know what they are talking about.

Example: “This investooooor doesn’t know anything about crypto”

- Rekt

A misspelling of “wrecked”, rekt is a crypto slang term that means you lost money or the market crashed. It can also be used loosely to mean something bad happened to you or something else.

Example: “We got rekt really bad last week, I hope we bounce back”

- Down Bad

Down Bad is similar to rekt, but not as severe. Crypto traders will say they are down bad when they lose money or the market falls unexpectedly.

Example: “I forgot to exit my trades yesterday before the crash so I’m down bad”

- Pump It/Dump It

Pump it/Dump it is both a scheme and a common slang term. Pump it/dump it schemes involve artificially inflating the price of a coin (pumping) and then selling all or a large portion of their crypto at the peak (dumping). This is not uncommon and most evident when large holders of crypto (whales) do it. Because crypto is extremely speculative and volatile, pump it/dump it can be used as a general term for the nature of crypto.

Example: “News really pumped up the price, now everyone is waiting for the dump”

- Nuke

Because of the volatility of crypto markets, strong price corrections and pullbacks are relatively common. Major corrections are sometimes referred to as nukes.

Example: “Nuke it so I can buy lower”

- NFA

NFA stands for “Not Financial Advice”. This is similar to NLA (Not Legal Advice) and is a disclaimer that advice is not from a professional. It is used to show opinions and views should not be taken as fact. It can also be used ironically.

Example: “NFA, but I think a big boom in price is coming”

- In It for the Tech

In it for the tech means that your views and positions are not just for profit but because you like the technology of a particular coin. This phrase has also become a meme of sorts for those coping with investment losses.

Example: “I lost half of my portfolio today so good thing I’m only in it for the tech”

- Can Devs Do Something?

The question “can devs do something” is a meme that is used when prices drop on a particular coin. It is just a joke nowadays, but most likely originated from a serious question. Devs refer to developers or the team behind the project or coin.

Example: “dang, can devs do something about these prices”

- Copium/Hopium

Copium and Hopium are crypto slang words used to express people’s illogical or fantasy hopes in a particular coin or price change. It figuratively means that you are taking or on “copium/hopium” when expressing these hopes.

Example: “The prices are never coming back up, you are on hopium”

- Bulla/Bera

Bulla/Bera are just misspellings of the bull and bear markets. While not commonly used, they are used in memes.

Example: “This bulla market got me hyped!”

Example: “stop being bera, we are going to bounce back”

- Funds are Safu

Funds are safu is a way of saying funds are safe. This is commonly used when investors inquire about the legitimacy and security of an exchange or smart contract.

Example: “The exchange was hacked but my funds are safu”

- Rugged

Rugged (Rug in the past tense, not the word rugged) or rug pull is the action of scammers or a shady development team pulling funds out of a project without consent or warning. In high-risk projects, this is a possibility and everyone loses the money invested in a project. Having the “rug pulled out from under you” also can be used to say you got scammed or deceived.

Example: “This shitcoin just rugged all of us!”

- Hsbaf

hsbaf means “Holy Sh*t bears (or bulls) are f*cked. Referring to the bears/bulls (those who thought the price would go a certain way and opened a position) will lose money.

Example: “Hsbaf with this unexpected news”

- Hfsp

Hfsp means “Have fun staying poor”. It’s used to ridicule those who are not in crypto or those who are overly cautious with their money. It’s used in a mean and derisive way.

Example: hfsp while these altcoins moon”

- Exit Liquidity

Exit liquidity is what people call those who are late to the party and only in it for quick profits, similar to apes. Early investors may use apes or moonboys as exit liquidity to get out of their position before the market turns.

- 69/420

69/420 is a common meme that is used to troll or be funny. 69 is a sexual position, and 420 is used to express marijuana. Companies or people will use these numbers (whether it is fund limits, collection amounts, or coin amounts) to be funny.

Example: “We minted 420 million coins at $69 each”

- IDO

IDO is not actually slang but a widely used acronym in the crypto space. It stands for Initial DEX Offering and is one of the hottest new ways for crypto projects to fundraise. IDOs use launchpads such as Scaleswap as a platform to organize, advertise, and crowdfund new projects. These platforms are especially valuable to crypto investors because they allow the average user to participate in early fundraising rounds for innovative new projects. In the past, these rounds were only reserved for big time investors and venture capitalist. For an in-depth analysis of IDOs and the benefits they bring to participants, take a look at this article.

Example: “How do I participate in an IDO on Scaleswap?”

Conclusion

Congrats! Now that you know the essential crypto slang terms, you’re probably excited and want to get started in the crypto space. To learn more about crypto wallets and how to store cryptocurrency, check out our article including the five best crypto wallets. To learn more about IDO launchpads like Scaleswap, where you can get early access to tokens of the newest and most innovative crypto startups, check out our website to get started.

The post Crypto Slang Terms Every New Investor Needs to Learn appeared first on Scaleswap.

]]>The post What Is Polygon (Matic)? Here’s Everything You Need To Know About the Ethereum Scaling Platform appeared first on Scaleswap.

]]>Understanding Polygon

Matic Network roots back to 2017 before it was rebranded as Polygon in 2021. Polygon solves scalability issues for the widely-used Ethereum blockchain. Namely, it addresses some of Ethereum’s fundamental drawbacks, such as limited bandwidth and lack of community management. How? Polygon combines plasma sidechain technology with Rollups to connect and scale blockchains.

More of visual perception? Check out the video: What is Polygon?

Polygon and MATIC: What’s the Difference?

Polygon had survived water and fire since its foundation back in 2017. The platform was initially named Matic Network and concentrated on the PoS layer and plasma solutions. A couple of years later, the crypto community witnessed a massive MATIC token launch on Binance. The network has steadily evolved since then.

In 2021, Matic Network changed its name to Polygon. A rebranding campaign happened because Matic was associated with sidechain technology, while a brand new Polygon stood for a multi-layer & versatile approach. Even though Polygon has greatly expanded the concept outlined by the Matic Network, it still utilizes the MATIC token.

You can check out the Coindesk’s digest to learn more about the difference.

Advantages of Polygon

Polygon paves its way through other Layer-2 (L2) blockchains and brings lots of innovations as it was the first decent option available to scale Ethereum-powered startups. What’s the big deal about it, though?

Polygon targets a particular market, which is good as demand only grows. Most Web3 developers are focused on Ethereum itself or EVM chains because if a project supports/works on Ethereum, the hiring process becomes super streamlined.

Developers can easily build and upgrade dApps on Polygon to access much broader markets, resulting in higher efficiency and better KPIs. Why? Startups launching on Polygon get what they need the most. Whether it’s security, transaction speed/cost, or sovereignty — Polygon has it all. The platform’s architecture is as abstract as possible, which is perfect for scaling and building any Web3 project.

Imagine launching a Web3 FinTech startup and dealing with money transactions. In this case, the obvious priority would be security, as you don’t want to lose your customer’s money. Some projects might not need such a layer. The beauty of Polygon is that any developer can take an extra security layer if wanted to, but the layer is not provided by default. In other words, additional security is rather optional than obligatory. If you decide on additional validation, you can activate it.

The Web3 teams also don’t carry any risks related to their dApps being outdated, as Polygon implements a whole range of tools, creating a flexible and future-proof network. Versatility becomes essential for those who enter the Web3 space over the long haul.

Disadvantages of Polygon

Some crypto enthusiasts consider Polygon as temporary salvation before Ethereum 2.0 arrives. Others claim the EVM chain can’t provide high-level security Ethereum does, and neither it’s as cheap as separate Rollup solutions like Arbutrum and Optimism. Let’s dig.

Simply put, the safety debacle is not the case for Polygon. Another 400-pound gorilla in the room is Ethereum 2.0. Should developers be skeptical about Polygon? The short answer is no, simply because everything won’t necessarily go as scheduled for Vitalik Buterin’s Ethereum 2.0.

Make sure to check this digest to learn more.

What Are Layer-2 Solutions

Layer-2 is a technology running on top of a Layer-1 blockchain such as Ethereum or Bitcoin to increase scalability and efficiency. L2 offloads the parental chain, putting off transactions to a faster sidechain, which performs most of the network’s processing. Once the calculations are made, the sidechain reports back, sharing only the final results. As a result, the core chain becomes faster and more scalable.

Imagine a broad congested highway during peak hours. That would be the Layer-1 Ethereum network. Now add several side roads, which are Layer-2 solutions operating in conjunction with the highway. Polygon builds and maintains side roads. It also employs a set of other scalability features to put off the strain from the parental Ethereum network and therefore makes trading and exchanging crypto much faster and cheaper.

Architecture

Polygon Labs builds and scales other blockchains, always keeping the most prominent Ethereum chain in mind. The ecosystem revolves around developers, dApp building, and scaling. But how exactly do they launch, bootstrap, and maintain technical components behind over 19,000 Polygon-based projects?

Polygon implements multiple complementary scaling solutions along with its core Plasma Chain concept, making the ecosystem quite complicated to understand yet flexible and effective. You can check a simplified beginner’s guide to Polygon MATIC or get the full knack of Polygon.

Here is the complete suite of scaling solutions:

- Polygon PoS — an EVM sidechain

- Polygon Edge — a framework to build EVM chains

- Polygon Avail — off-chain scaling for EVM chains

- Polygon Zero — zkRollups powered by Plonky2

- Polygon Miden — zkRollups powered by STARK

- Polygon Hermez — open-source zkRollups

- Polygon Nightfall — high-end privacy Rollups

- Polygon Supernets — build blockchains using Edge+

The ecosystem has other products being developed, but let’s focus on core technologies Polygon implements to grow and scale Web3.

Proof of Stake Sidechain

Polygon brings a sidechain that adds a PoS layer to a blockchain. Such a blockchain keeps Ethereum’s security while being blazingly fast, especially if combined with Rollups.

This is the easiest way to scale dApps built on Ethereum, as the PoS sidechain is a battle-tested technology with over 1 billion transactions and close to 3 million monthly users worldwide.

Plasma Chain Technology

A Plasma Chain is another core technology behind many Polygon products. Plasma chains use fraud proofs to arbitrate disputes within a blockchain, significantly boosting transaction speed. These chains are also referred to as child chains because they’re substantially smaller than the parent chain. Each chain has its own transaction validation process. There’s no limit on how many child chains can be created. However, they only support simple transactions like swaps and token transfers through the plasma bridge.

zkRollups

Zero-knowledge Rollups accelerate the Ethereum parent chain through an extra L2 chain, which is a side chain built on top of L1. Nonetheless, the data or outcomes of such transactions are stored on L1 in a specific smart contract. Users can recover their assets even if the L2 network fails because the L1 smart contract will continue to function. Utilizing zKRollups Polygon delivers better throughput and cheaper costs than any other developed on Ethereum, while its non-custodial approach increases security for centralized exchanges.

zkRollups collect multiple off-chain transactions and develop ZK-SNARK, a cryptographic concept that allows a party to demonstrate that it has specific data without disclosing the data itself. The concept is widely used among top-tier blockchains to provide users privacy and validate each block added without the trust issue.

zkRollups guarantee their truthfulness by mathematical evidence instead of the optimistic Rollups method assuming validators are truthful. All transactions are routed through L2, whilst zkSNARK is assigned to L1. The biggest advantage of zkRollups is their security comparable to Ethereum’s parental chain.

zkRollups cause no delays when it comes to asset transfers from L2 to L1 because the contract approves such transactions by default. Moreover, zero-knowledge Rollups minimize transaction size, which leads to significantly reduced gas fees.

Optimistic Rollups

The optimistic Rollups technology doesn’t compute anything but proposes a new state for the Mainnet, which attests to a transaction. It works simultaneously with the L2 chain and reduces gas fees while boosting the main chain up to 100 times due to the embedded Calldata function.

Developers might combine Rollups with sharding technology in the future, smashing transaction speed limits. Polygon’s Rollups have been in the works for a while now; the same is true for a rumored Ethereum 2.0 sharding technology. Once that happens, both chains can benefit.

How Polygon Works?

The Polygon’s structure reminds those of Polkadot or Cosmos, yet it has some unique features. The architecture comprises four abstract layers — two base layers and a pair of optional layers:

- Execution layer (base) — execution layer is responsible for operational tasks & smart contracts execution. In some way, it’s Polygon’s EVM vision.

- Polygon networks layer (base) — the ecosystem’s backbone. Each network within this layer has its own sub-community, consensus, and blockchain building.

- Ethereum layer (optional) — a collection of Ethereum-implemented smart contracts that manage transactions across chains.

- Validation layer (optional) — security layer operates in tandem with Ethereum and provides extra validation service.

You can think of Polygon architecture as a pyramid with four steps. The first and foundational step being the execution layer, while the Ethereum layer peaks the structure up. As a result, Polygon-powered dApps can interact with EVM chains and Ethereum, resulting in high-end interoperability. Other features like plasma chains, Rollups, and more complement the overall structure. A vivid example would be the core arbitrary messaging feature that has partly boosted the intrachain value exchange and launched a new bridge-building era for the whole crypto world.

Which Consensus Polygon Uses?

Polygon uses the Proof-of-Stake (PoS) consensus mechanism to create MATIC tokens and secure the network. The basic idea of PoS is quite simple and related to the concept of Proof-of-Work (PoW). New to crypto? Learn more about the PoW consensus mechanism.

The PoW concept requires its members to invest computing power (e.g., mining equipment) to solve mathematical problems generated randomly. This is required to protect the network from unilateral control and manipulation.

Now let’s get back to Polygon’s PoS. Here is a brief example of how PoS works compared to the PoW mechanism:

- Instead of buying $1,000 worth of mining equipment, users can stake $1,000 value in MATIC tokens.

- Users can sign their vote with a digital signature instead of specifying which blocks are valid via mining. The block with the most votes wins instead of the block that spent the most resources mining.

- If the nodes behave maliciously, they will lose their entire staked share instead of losing the reward for the work done.

Validators that hold a substantial amount of MATIC tokens do the main job within the Polygon ecosystem. Due to the large share of tokens, the validator acts as a proxy for the system. Validators verify new transactions and add them to the blockchain, for which they are rewarded with commissions and new MATIC tokens.

The second group of users is called delegators. They deposit their MATICs indirectly through trusted validators. This staking option involves less commitment and requires analyzing the environment. If the chosen validator acts maliciously or makes mistakes, the delegator can lose its MATICs.

Polygon Bridge

Polygon has two bridges — the Proof-of-Stake Bridge and the Plasma Bridge. Even though users can transfer their assets blazingly fast via both Ethereum-Polygon bridges, each has its specifics.

PoS Bridge is more reliable for a broader audience as it uses a widely adopted consensus mechanism and works with common ETH token standards, including the most popular ERC-20 standard.

Plasma Bridge is more suitable for developers, as they usually prefer additional security over anything else. The bridge supports common ERC-20 and ERC-721 (NFT) standards. You can have a detailed look at Ethereum protocol standards on our blog.

Polygon’s Software Development Kit (SDK)

The Polygon SDK is a tool designed specifically for developers. SDK plays a vital role in L2 development and Ethereum’s low-gas future. Developers on Polygon can create the following:

- Standalone EVM blockchains

- L2 protocols directly connected to Ethereum

Polygon SDK developers can use a bunch of open-source resources available and integrate additional modules. Here is the list of some tools developers can use:

- Open wallet API — to integrate Web3 wallets

- Token Mapper — Ethereum to Polygon mapping

- Faucet — to test your network’s performance in advance

- Matic JS — a ready-to-go integration library

- Polygon Bridge widget — to connect your dApps in the blink of an eye

Want to know more? Make sure to check the official SDK announcement in Polygon’s blog.

Popular DApps Using Polygon

More than 19,000 projects have already been built on Polygon’s technology. Here is the list of popular projects on Polygon.

- Exchanges: Binance, Coinbase, FTX, Huobi, Uniswap, 1inch and more

- NFT games & collection: Decentraland, Aavegotchi, Bloktopia, Derace, Coolcats

- DeFi protocols: Yearn.finance, Bancor, Aave, Balancer

- Tools: Polyrare, Polytools, Ceramic Network

- dApps: Scaleswap, Procial, Vodra, The Ally

The Web3 applications built on Polygon are safe, scalable, and fast. Let’s take a decentralized multi-chain fundraising platform Scaleswap as an example. The platform has picked Polygon along with Ethereum, Binance Smart Chain, Fantom, and Harmony chains to make IDO projects more attainable to the community members.

Scaleswap provides its sustainable community with access to innovative projects and early-stage IDO investment opportunities across five blockchains, including Polygon. Teams and projects benefit from streamlined crowdsource funding, reliable community, and turnkey incubation support.

Future of Polygon

Although many assume the Ethereum 2.0 hard fork would leave little room for scalability, Vitalik Buterin himself expects a bright future for Polygon because Polygon has a dedicated developers community and constantly-updated products.

Not long ago, the Polygon Supernets blockchain building solution was rolled out. The technology relies on the previous Polygon Edge concept yet fetches a fresh perspective for blockchain fast-tracking and broad adoption. Polygon is also associated with a series of Web3 fundraising & startup acceleration initiatives. The platform supports NFT, Gaming, and Metaverse projects built on Polygon, paving its way into upcoming trends.

Even though Polygon has a long way ahead, it might flourish as the ecosystem is home to over 19,000 dApps. Does it mean Polygon is too big to fail? History shows that nothing is.

FAQ

How much are MATIC coins worth?

As of April 27, 2022, MATIC coins are worth $1.26 per coin, according to the Coinmarketcap and CoinGecko data aggregators. Using these platforms, you can always check the Polygon price history and current charts.

How many Polygon coins are there?

The total supply for Polygon is 10 billion tokens. As of April 27, 2022, the circulating supply reached 7.85 billion MATIC coins, which means 78.5% of MATIC has already been issued. The number always changes as some new tokens flow into the market or are burned. The overall model for MATIC is deflationary, meaning that the number slightly decreases over the long term.

How can I buy MATIC?

You can buy MATIC on any major centralized exchange like Binance, Coinbase, FTX, etc. Another way to purchase Polygon’s native tokens is through decentralized exchanges or aggregators like Uniswap, SushiSwap, and 1Inch.

How Many dApps Does Polygon Have?

Polygon is used by over 19,000 dApps globally. You can explore some of them on Polygon’s official website.

The post What Is Polygon (Matic)? Here’s Everything You Need To Know About the Ethereum Scaling Platform appeared first on Scaleswap.

]]>The post Whitelist Meaning Explained – What is Crypto and NFT Whitelisting? appeared first on Scaleswap.

]]>Whitelist Definition

The term whitelist has slightly different meanings on different platforms and domains of the crypto world. In general, it’s used to describe the pre-approval of a crypto wallet address. This pre-approval process could be for a token offering, early NFT purchase, the withdrawal of funds from a centralized exchange, or access to any other exclusive crypto event.

Let’s dive into some of the common scenarios where a crypto user would need to whitelist a wallet address.

What Does It Mean to Be Whitelisted?

Before an IDO (Initial DEX offering), NFT drop, or any other exclusive crypto event, interested individuals or entities may have the opportunity to gain early access to acquiring a crypto asset by applying for the project’s whitelist.

To be whitelisted means that you have completed the steps outlined by the project’s team and your wallet address is now eligible to participate in the event at a specified time and place.

Benefits of Being Whitelisted

Whitelisting is a tool that allows teams to reward active supporters and incentivize community participation towards the growth of the project. In exchange for meeting the predetermined guidelines for eligibility, supporters are rewarded with early and guaranteed access to an exclusive offering.

This ensures that you’re getting the token or NFT before it hits the secondary market, which also means there’s a good chance you’re getting in at the lowest price possible.

If you’re not familiar with the term “IDO” and how to get early access to the tokens of innovative blockchain-based startups, then we strongly urge you to learn more about Scaleswap here.

Exchange Withdrawal Address Whitelisting

Another place you may want to whitelist an address is as a security feature on a crypto exchange. When the address whitelisting feature is disabled, a user can freely withdraw from an exchange account to any other address they would like. However, when this feature is enabled, the user can only withdraw to an address that has previously gone through the whitelisting process, which can take anywhere from 1 to 7 days depending on the exchange.

This added measure of security is highly recommended as it protects against:

- Accidental transfers of crypto to an unintended address – Crypto addresses are the only means of identification for a sender or recipient on any given blockchain network. Since they are simply a string of alphanumeric characters, it’s not uncommon for users to make a mistake when typing or pasting the address.

- Compromised accounts – Enabling the address whitelisting feature provides a bulletproof layer of security by preventing a hacker from transferring assets away from your exchange account.

How to Get Whitelisted for an IDO or NFT Launch?

Investors must usually take several steps to enter the whitelist and gain the opportunity to participate in an IDO or NFT launch. You’ll need to review the exact terms laid out by the project’s team to determine the necessary steps.

These tasks usually include user-generated content, social media support, referrals, and other actions that help create brand awareness for the project.

In addition, most IDO platforms have budget-driven selection criteria for whitelisting, requiring you to purchase a large number of platform tokens. This favors the wealthy and puts whitelisting out of reach for the average crypto user.

In the case of IDOs on Scaleswap, a loyalty-based scoring system is the primary method for whitelisting participants. With a minimal impact on buying power, this evolved form of whitelisting keeps the financial barrier low enough for anyone to participate. Be sure to read our how to get started article to learn more about the IDO whitelisting process on Scaleswap.

How to Whitelist a New Address on an Exchange

As noted above, crypto exchanges provide withdrawal address whitelisting as a security feature to protect your crypto assets. In this section, we provide a step-by-step example of how to whitelist an address on Binance Exchange.

- On the Binance home page, navigate to Profile > Security >Address Management

- Enable whitelist activation

- Complete two-factor verification (2FA)

- Go to: “Add new withdrawal address”

- Specify the coin for the withdrawal address and assign a name (or tag)

- Submit

- Complete two-factor verification (2FA) again

- Confirm an activation email

- Now that you have specified the whitelist of withdrawal addresses. You can go to your account settings again and check the Address Management page.

The post Whitelist Meaning Explained – What is Crypto and NFT Whitelisting? appeared first on Scaleswap.

]]>The post What Is a Crypto Wallet? Here’s Everything You Need to Know to Get Started appeared first on Scaleswap.

]]>Basic Principles Of Working With Cryptocurrency

In order to transact and manage cryptocurrency, you must interact with the blockchain (The network and protocol that backbones cryptocurrency). This is accomplished by means of a crypto wallet. Crypto wallets do not store cryptocurrency on them. In reality, they are just an access point to the blockchain network.

Each wallet has its own unique identifier, known as an address. Similar to a building address, this lets others know where to send their assets, or where they came from. In addition, wallets have two kinds of “keys”. The public key is the address and can be freely shared to send or receive cryptocurrency. The private key is analogous to a password or physical key, and should not ever be shared with anyone. The power of the private key is that it connects you with your cryptocurrency, regardless of what wallet you use.

Features Of A Crypto Wallet

Blockchain technology was invented to minimize the drawbacks of conventional banking systems, and create a system that is secure, fast, transparent, and eliminates the need for a third party. As such, there are many features and benefits of using a crypto wallet:

- Low transaction fees – Because they’re no middlemen involved, fees to transact are typically much lower compared to traditional banking methods

- Fast – Funds are transacted quickly and seamlessly, and can be done anywhere in the world

- Transparent, yet anonymous – The blockchain is a transparent ledger where all activity is documented and visible, but users can remain anonymous and maintain privacy.

- Trustless – No third party means that you do not have to trust another entity with your assets, improving security and autonomy.

Types Of Crypto Wallets

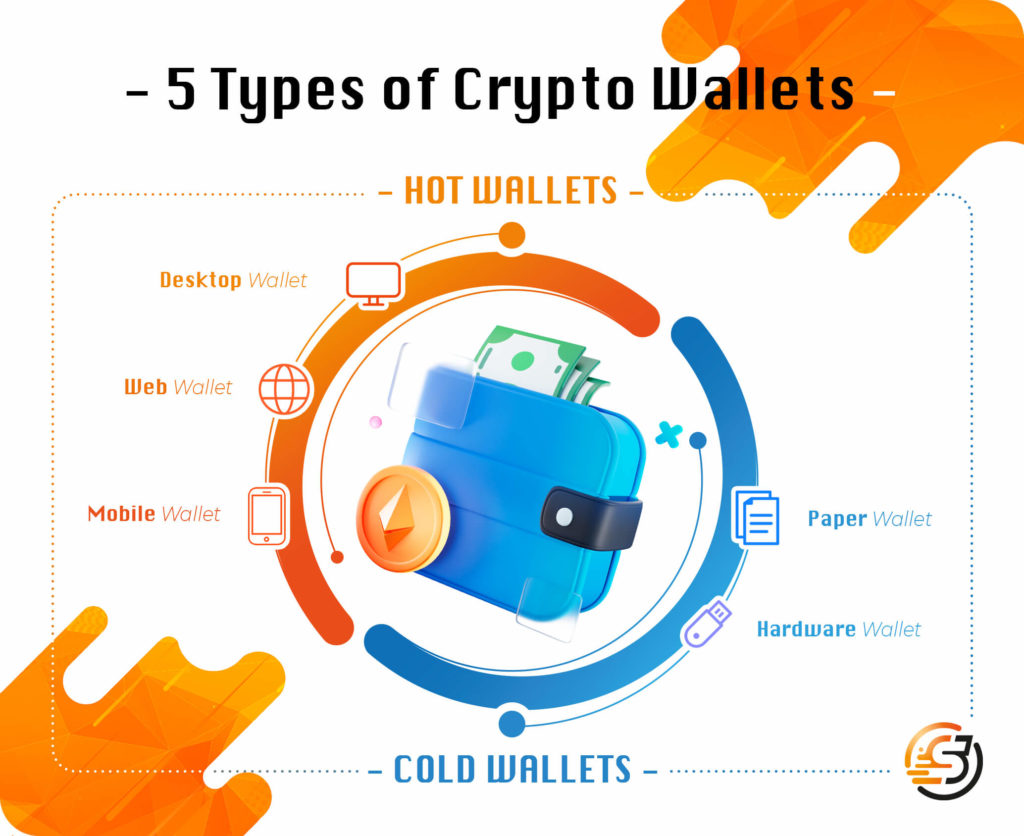

Crypto wallets come in many forms, which we will discuss in detail below. One important thing to note is that wallets can be labeled as “hot” or “cold”. In sum, a “hot” wallet means that it is linked to the internet. Oftentimes hot wallets are easier to access and manage. Alternatively, cold wallets are offline, offering superior security at the expense of less convenience. In addition, wallets can be labeled as custodial or non-custodial. Custodial wallets are wallets where the private keys are managed and stored by a third party. While this reduces the hassle of having to do it yourself, you are trusting another entity with your wallet. On the other hand, non-custodial wallets place the responsibility on the user. You have total command over your wallet and private keys, and don’t have to trust another entity with your funds (one of the reasons blockchain technology was invented!). However, all the responsibility is on you the user to store these keys safely. These terms are essential for knowing exactly how each wallet works.

The first three wallets (Online, Desktop, and Mobile) are classified in general as software wallets, using software to operate and maintain the wallet.

- Online Wallet

An Online wallet is a web or browser-based wallet that requires no installation of software. In most cases, you just need a password, and the private key is housed online by a third party. This type of wallet is extremely convenient, but is inherently hot, making it not as protected as cold wallets.

- Desktop Wallet

With a desktop wallet, you download software and manage your wallet locally on your computer. Desktop wallets can be stored cold on your desktop as opposed to the cloud. This offers more flexibility and safety than online wallets but with slightly less convenience.

- Mobile Wallet

A mobile wallet is exactly what you would expect: You access your wallet via a mobile app on your phone. It is nearly identical to a desktop wallet except it is optimized for smartphones. One main advantage is that QR codes can be used to send and receive funds, making mobile wallets extremely convenient and quick.

- Hardware Wallet

A hardware wallet is unlike software wallets. A hardware wallet is a tangible device, similar to a money wallet you could carry in your pocket. It is offline and possesses your private keys. To use it, you typically connect the device to a computer to access and manage it. Most recognize hardware wallets as one of the most secure and safe ways to manage cryptocurrency (especially large amounts) because it is less prone to hacks. In the event of a stolen or lost hardware wallet, there are safeguards to restore your account (like a backup seed phrase). Setting a pin on the device also adds further security in the event of theft.

- Paper Wallet

Paper wallets utilize a QR code to transact cryptocurrency. It is the most analog way to store your keys and is as secure as where they are physically located. However, due to issues recording this information on paper and the invention of hardware wallets, paper wallets aren’t as favored as other wallets and are becoming obsolete.

How To Set Up A Wallet

Before you set up a crypto wallet, there are some important points to think about before choosing to get the most out of your wallet:

- What cryptocurrency will be stored – Some wallets are only designed to handle certain cryptocurrencies. If you send an incompatible coin to an address (say, Ethereum to a bitcoin wallet) those assets are gone forever and impossible to recover. So, make sure your wallet is compatible with what cryptocurrencies you use.

- How the wallet will be utilized – Are you going to be transacting and using your wallet every day, or using it to store cryptocurrency long-term? Software or hot wallets are best for frequent users as they are convenient and fast. Cold and hardware wallets are more robust and secure, and more suitable for long-term storage or storing large amounts.

- Level of involvement – Do you want a wallet that is easy to set up and has minimum hassle? Or do you not mind learning a bit to get the most out of a wallet? Custodial wallets are often much easier to set up and use if you don’t mind trusting your private keys with another entity. Non-custodial wallets require more planning and involvement as you need to secure and manage your own keys.

Mobile Wallet Set Up

A mobile wallet is probably the easiest wallet to set up. You download an app with the crypto wallet of your choice and follow the directions. For apps such as Coinbase, you must set up an account and authenticate your identity to gain full access and capabilities of the wallet. Moreover, you are given a recovery phrase that you should store in a safe place in case of losing your phone.

Online Wallet Set Up

To set up an online wallet, you just need to launch a browser extension or sometimes visit a website. From there, you usually need to create a password and record your seed phrase. And that’s it, you can now send and receive funds with an online wallet.

Desktop Wallet Set Up

Setting up a desktop wallet is a little more involved than the previously mentioned online and mobile wallets. You must install an application to your desktop, where your private keys and wallet will be managed locally on your computer’s hard drive. One downfall of a desktop wallet is that in order to access it on a separate device, it must have the application installed on it as well. It is best practice to only access your wallet on trusted devices, with proper security measures such as two-factor authentication (2FA).

Hardware Wallet Set Up

A hardware wallet is the most time-consuming to set up and access, but with inherently greater security than other hot wallets. To set one up, you must first purchase the physical device. Follow the directions accompanying this device, which involves downloading an application to your computer to interface and interact with your physical wallet. Hardware wallets have many security features, such as a pin on your physical device in addition to password protection on the desktop application. In order to transact and manage the wallet, you should connect your device to your computer and launch the application. From there, you can buy/sell cryptocurrencies and authenticate the transaction on your physical device.

Utilizing Multiple Wallets

Having more than one wallet has many advantages. For example, setting up an online or mobile wallet allows you to start transacting quickly and effortlessly. You can then pair this wallet with a hardware wallet, sending assets over to be stored long-term more securely. It is also advantageous to store large amounts in this wallet while keeping assets that are traded often in the more convenient hot wallet. Just make sure to keep track of your private keys and recovery phrases in a secure location.

5 Best Crypto Wallets of 2022

Now that you know the various types of wallets and how each one works, here are five of the best crypto wallets to get you started:

- CoinBase Wallet

The Coinbase Wallet (distinct from the Coinbase exchange) is an excellent mobile wallet that is backed by a popular, reliable, and regulated entity. It is built to be user-friendly and simple, while also being secure. This is recommended for beginners who want to minimize risk and maximize peace of mind when managing their wallets. Coinbase also offers custodial wallets just by using their exchange. This is the easiest way to “set up” a wallet, but it is considered bad practice to leave large amounts of assets on an exchange or for long periods of time.

- MetaMask

MetaMask is a popular online wallet (via browser extension) that is simple to set up and manage. You just need a password and recovery phrase to get started. You can set up multiple wallets within MetaMask and it even has compatibility to link with hardware wallets such as Ledger Nano. Metamask is the most popular and versatile wallet if you want to participate in DeFi. To use decentralized apps such as Scaleswap, where you can gain access to early investment rounds of some of the most innovative startups in the crypto space, you’ll need to use Metamask. There is even a mobile wallet available for increased convenience.

- Ledger Nano S

The Ledger Nano S is one of the leading hardware wallets you can buy today. It offers compatibility with hundreds of cryptocurrencies and features Ledger’s Secure Element chip for supreme security. The Nano S is best suited to those wanting to store crypto long-term.

- Exodus

Exodus has a quality desktop wallet that has 24/7 human support, support for almost 200 cryptocurrencies (including Bitcoin), and built-in exchange. Additionally, it has support for Trezor, another favored hardware wallet.

- Crypto.com

Crypto.com offers non-custodial wallets that “give you access to a full suite of DeFi services in one place”. This is recommended for those looking to get the most out of decentralized finance (DeFi). DeFi gets the most out of blockchain technology, offering transparent, quick, and trustless finance without needing a third party.

Conclusion

Whether you prioritize speed and ease of use or complete security and control, you now have the tools to decide which wallet suits your needs. Each wallet is unique and has distinct features. Centralized custodial wallets offered by companies like Coinbase and Crypto.com are a safe, familiar, and common way to get into crypto. Non-custodial wallets offering access to cutting-edge DeFi services and platforms (like a MetaMask wallet to use Scaleswap) open the door to the exciting, decentralized, and interesting world of crypto.

Once you get your wallet set up, be sure to check out our introduction to crypto exchanges article to learn about the best places to buy and trade your first cryptocurrencies.

The post What Is a Crypto Wallet? Here’s Everything You Need to Know to Get Started appeared first on Scaleswap.

]]>The post What Is an IDO and Why It Matters appeared first on Scaleswap.

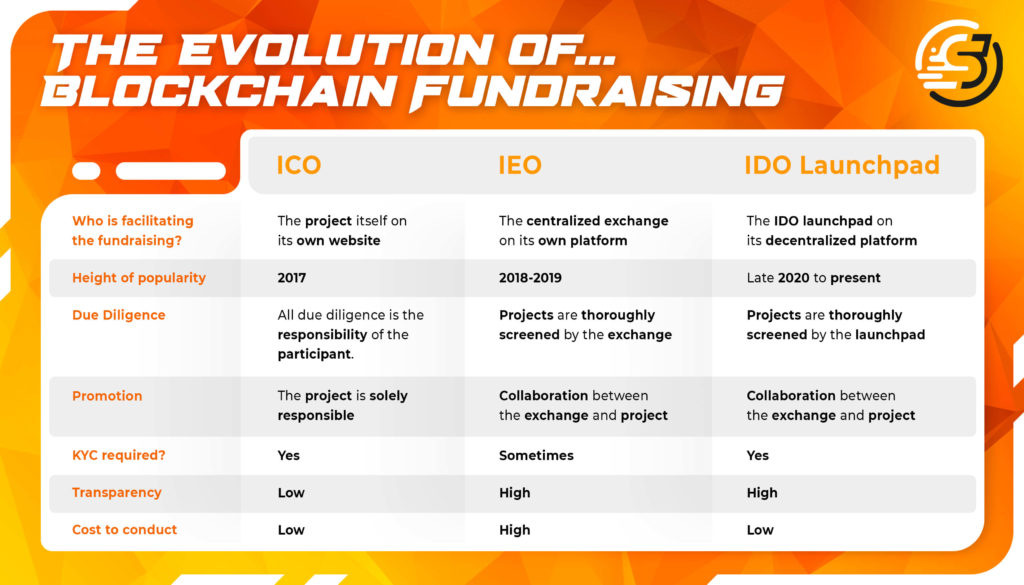

]]>IDO vs IEO vs ICO: A Complete Comparison

One of the most important steps for an innovative startup is fundraising. Fundraising allows the founders to secure capital, develop their product, and grow significantly faster compared to a project that doesn’t raise money.

There are many ways a project can raise money, especially a crypto project. The most traditional method outside of the crypto space is an IPO, or initial public offering. In short, the company offers shares, or equity in the company, in exchange for capital. While this is an effective way to fundraise, many early startups are hesitant to take on additional partners and give up too much control. Luckily, crypto projects have a number of alternative ways to raise funds and bootstrap growth while retaining optionality: Initial Coin Offerings (ICO), Initial Exchange Offerings (IEO), and the most promising method, Initial DEX Offerings (IDO).

What Is An ICO?

An ICO was the first and most popular form of fundraising for projects in the crypto space. As previously stated, projects don’t want to give up equity in their project. Instead, the blockchain-based startup offers tokens, which typically have built-in utility or access to the project’s platform or service. Early investors purchase these tokens in the hopes that the company grows and succeeds, in which the price of their token increases as well.

How does an investor know which ICO to invest in? When the ICO is launched, the details about the project’s mission, its use case, and the timeline are also released in a document called a whitepaper. This is how the company summarizes what it is about, as well as marketing its value so it can have a successful ICO

There are three main paths an ICO can take. The first is having a fixed supply and fixed price. The amount of coins or tokens offered doesn’t change, nor does the price set per token. This is typically done when a project has a specific goal in mind. The next way is still having a fixed supply, but allowing for a dynamic range in price, where funding determines the overall cost per coin or token. The last way is to establish a fixed price with the supply remaining dynamic, so funding ultimately decides the supply.

Advantages

- Ease – Both for the token issuer and investor, the ease of participating in an ICO makes it attractive for all types of investors and generally reaches a larger audience than an IPO.

- No loss in Equity – The project team is not required to give up any equity in their idea to get funding, which is often essential for startups in their early stages of development.

- Incentivised community – Issuing tokens incentivizes the community to advocate and support their project; everyone has a vested interest in seeing the project succeed.

Disadvantages

- No guarantees or protections – ICOs are not regulated, so there are minimal to no protections for investors in the event of a scam or technical fault.

- Legal Issues – Many countries like China, France, Russia, and Thailand have either heavily restricted or outright banned ICOs. In the US, the SEC is cracking down on ICOs as they can be viewed as securities and thus subject to various US laws. The uncertain future of ICOs makes it unappealing to investors and startups wanting to raise capital via an ICO.

- High risk of scams- Due to its unregulated nature, ICOs have a high potential for scams and places all of the risk on the investor.

- Not much transparency between customer and token issuer – Besides what the token issuer and project state in their whitepaper, there isn’t much transparency or assurances in the ICO process.

The ICO model is far from a perfect system. In fact, ICOs are no longer used to fundraise crypto projects because of the overwhelming disadvantages, particularly the high risk of scams.

What Is An IEO?

The eventual fall of the ICO led to the rise of the IEO. An IEO is similar to an ICO, but with one crucial difference: An exchange facilitates the token sale. The exchange vets the crypto project applying for an IEO; it looks at the whitepaper, the team, the tokenomics, and many other checks to verify the project is legitimate.

Because of this, those applying for an IEO are typically more developed and have a minimum viable product (MVP) to market to investors. In short, the exchange serves as a middleman between investor and token issuer, mitigating risk that would be present in an IC

Advantages

- Vetted project – Because an exchange facilitates the IEO, it doesn’t want scams on its platform. Thus, each project that applies for an IEO is thoroughly vetted. This gives investors some security and piece of mind when investing in a project.

- KYC/AML Measures – Know Your Customer and Anti-Money Laundering measures also add security to both parties unlike an ICO.

- Seamless – Typically, the user experience is much more seamless in an IEO as the exchange facilitates the transaction and marketing.

Disadvantages

- Centralized – Perhaps the biggest advantage of blockchain technology is its decentralized nature, and an IEO is the opposite of that. Many crypto investors and enthusiasts want the benefits of decentralization such as transparency and being anonymous.

- Only available to exchange users – To participate in an IEO, investors must become users on that particular exchange. This may limit the audience of the project and limit fundraising.

- Fees – Because the exchange expends resources and time on the vetting process, projects typically must pay steep fees in order to launch an IEO. This was simply not a viable option for most startups.

The Rise Of Initial DEX Offering (IDO)

One of the most recent and promising ways for projects to get funding is via an IDO. An IDO originated as a token offering done through a decentralized exchange. There is no middleman involved like in an IEO, offering peer to peer transactions that increase transparency while minimizing risk. The IDO model was developed to avoid the drawbacks of both ICOs and IEOs, leveraging decentralized blockchain technology to achieve superior useability and security.

How Does An IDO Work?

Initially, IDOs used decentralized exchanges (DEX) and smart contracts to facilitate the transfer of tokens and funds between parties. They’ve since mostly migrated to being held on specialized platforms called IDO launchpads. These launchpads help mitigate the risk of investors with large crypto wallets (also known as whales) buying a large majority of the tokens in an IDO.

On an IDO launchpad, the transfer of capital for tokens is done quickly and seamlessly compared to ICOs and IEOs. As a result, there is no delay for funds and investors usually get instant liquidity. In addition, the vetting process for an IDO on a launchpad is done collectively by the team and community rather than a centralized exchange, which benefits investors and increases security.

What Are The Advantages of An IDO?

- Decentralized – IDOs utilize blockchain technology to facilitate the IDO transaction, making it much more transparent and secure than ICOs and IEOs.

- Vetted projects – IDOs hosted on a DEX are still vetted, albeit by the community, not just the exchange. IDOs hosted on an IDO launchpad are usually thoroughly vetted by the team and/or a special counsel, as well as the community.

- No fees – IDOs avoid the high fees that are associated with launching an IEO and listing on an exchange, so it’s cheaper and easier for startups to launch an IDO.

- Safer – While there’s no such thing as no risk, IDOs are at much lower risk of being hacked because they don’t store funds like centralized exchanges do.

- Immediately listed – An advantage of IDO is that the transaction is instant, so both parties have access to their funds/tokens immediately. However, for IDO members, there are often vesting schedules attached to the token being acquired so you’ll need to make sure you read the terms before participating.

What Are The Disddvantages of An IDO?

- No stable price – While IDO offers instant accessibility to investors, this accessibility (particularly shortly after listing) can make the price of the token extremely volatile.

- Market Manipulation – When new tokens are able to be traded, there is always the risk of “pump and dumps” where the value of the token is artificially inflated and then a large amount of those tokens are sold off. That’s why it’s important to choose an IDO or an IDO platform carefully.

What is the Future of The IDO Model?

IDO has a lot of advantages over ICO and IEO models, and it leverages the most out of blockchain technology. However, centralized exchanges are more ubiquitous, and much more user friendly to the general public and novice crypto traders. For IDO to transition to a mainstream fundraising mechanism, a couple things need to happen. First, IDO needs to be user friendly and accessible. As cryptocurrency and blockchain technology become more commonplace, public awareness will grow. This will help new investors enter the space and participate in IDOs, without the need for extensive crypto knowledge.

Fortunately, the ascent of the IDO launchpad helps make IDOs accessible and relatively easy to use. An IDO launchpad is a specialized platform for startups to launch from (hence the name) and crowdsource their funding. Launchpads are more user friendly, have their own community, usually accompanied by their own utility token as well. Startups are vetted through the launchpad, and then the launchpad community gets the opportunity to invest in new crypto projects.

Scaleswap IDO Launchpad

While IDO launchpads are revolutionizing decentralized fundraising and already being incorporated into almost every new project’s go-to-market strategy, there are still some kinks to work out when it comes to fairness and barriers to entry for newcomers.

Currently, this selection process on most IDO launchpads for deciding who is chosen to participate in an IDO is either luck-based or purely budget-driven – with some of the top launchpads requiring users to hold tens of thousands of dollars worth of tokens to achieve guaranteed allocation in an IDO launching on their platform. This is simply not fair to the average DeFi user,” said Ralf P. Gerteis, CEO of Scaleswap.

Scaleswap aims to eliminate these barriers and increase fairness and transparency through a loyalty based scoring system for its users. ScaleSCORE is a multidimensional scoring system that empowers users based on their commitment, with the lowest possible impact on actual buying power. By valuing community over budget, Scaleswap is providing a way for anyone to increase their score and participate in IDOs, regardless of their starting budget.

This also has a positive effect for the projects launching on the platform because they can tap into this carefully cultivated community to bootstrap growth and strengthen their launch strategy.

How To Buy Tokens Through an IDO Launchpad

So you know all about IDOs, but how do you participate? The majority of IDOs are now hosted on IDO launchpads, not decentralized exchanges. So, typically you must become “whitelisted” by a launchpad, which means chosen to engage in new IDOs. Each launchpad has its own guidelines and paths to get whitelisted.

While some launchpads use purely financial metrics to decide participation, others like Scaleswap’s ScaleSCORE take loyalty and involvement into consideration. Also, those who hold the launchpad’s utility token typically get more entries to participate. Once you’re whitelisted and gone through KYC, congrats! You can now buy tokens for that IDO, and the launchpad will likely send you the information you need to prepare.

Conclusion

How crypto projects fundraise money has evolved significantly over the past few years. Each step of the way saw increased security for investors, minimized risk to scams, and an overall better experience for all parties involved. The evolution of decentralized fundraising via IDOs led to the creation of IDO launchpads. Currently they offer a safe, easy, and seamless way to participate in IDOs. The future of cryptocurrency as a whole is away from centralization and towards decentralization, which IDO launchpads embody and promote. This is why IDOs and IDO launchpads are the future of fundraising.

The post What Is an IDO and Why It Matters appeared first on Scaleswap.

]]>The post The Top 10 Essential Crypto and DeFi Apps For Beginners appeared first on Scaleswap.

]]>In this guide, we will be taking a look at the Top 10 recommended applications for crypto beginners that can help to provide the best overall experience when getting started. This list ranges from exchanges, wallets, tools, and more. Although this is a top ten list, these are not in any particular order.

Let’s begin.

MetaMask

When choosing many of the available apps and services out there, it is vital that someone uses a wallet for the crypto needs. MetaMask is a very popular decentralized wallet that’s one of the most compatible wallets in the space. Using MetaMask helps keep your portfolio completely decentralized and keeps you in complete ownership of your coins.