Decentralized finance and other categories of blockchain-based technology like DEXs, IDOs, and yield farming have been some of the best technologies of the decade. The concept of using these technologies brings new life into a long-established world of financial activity and exchange. This is great for the average user but for businesses and services, this brings unique challenges where they want to entertain the services for users while also making sure their risk of doing business is worthwhile for all parties involved. This is where KYC comes in.

In this article, we would like to share what KYC is, what it really means, the different types available and how it is used, why it is used at ScaleSwap, and some examples of healthy KYC used around the world.

What is Know Your Customer?

KYC, also known as Know Your Customer, is a tangible and dynamic process that businesses and companies can use to confirm the identity and/or risk of any one person or people. This is seen as an act of “due diligence” by the business or institution that helps them understand who they are interacting with and what general expectations they can have if they do so. In many cases, businesses and blockchain-related protocols need to understand who they are dealing with. Establishing a KYC system helps businesses to parse out problematic interactions or possible issues like security risks, hacks, and lack of liability.

Using KYC has always been a double sword in the crypto world because of the nature of decentralization and P2P exchanges, even with protocols like DEXs and IDO events. The great thing about ledger-based technology is things can be used without the need for KYC. The issue of this is the large assumption of risk that businesses would need to take when offering a service, especially when exploits can and do happen often. It is within reason that businesses and exchanges might consider investing in KYC technology to maintain a barrier of confidence in any interested parties, especially when millions and even billions are at stake.

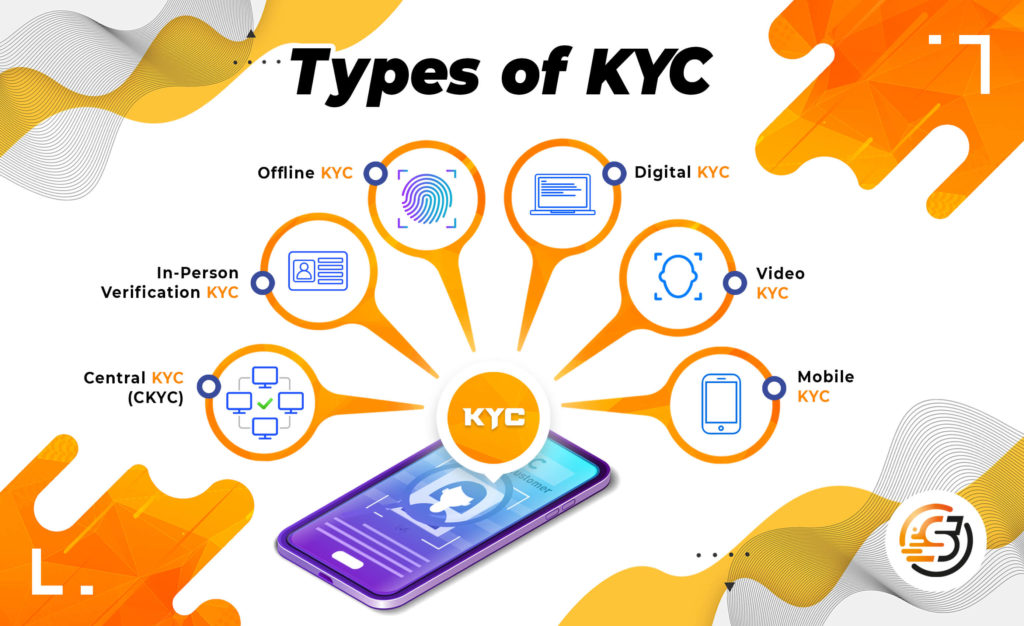

The Different Types of KYC

Although KYC is a structured set of actions taken to enhance security and reduce outside risk, it is also dynamic in the sense that it comes in various forms. KYC comes in all shapes and sizes and can vary depending on the type of service involved, the type of exchange, or even what type of device or environment it takes place in. Here are a variety of common places and ways KYC is used:

- Digital KYC: probably one of the most common forms of KYC as the average person uses today, digital KYC is a process by which users can verify their identity by using digital tools or resources that can be exchanged via the internet, software, or device. Some of the most common examples are things like emails, two-factor authentication, and passwords. This also encompasses more complex means of KYC including biometrics, IP address and location verification, pictures of yourself or others, sending documents like passports online through secured means, and much more.

- Video KYC: something that could be considered part of the digital KYC system, video-based KYC is used and is very effective to prove one’s physical identity. This is commonly used with recording one’s self through a camera, either in person, live stream, or recording and sending a video through digital means. Video recording, especially above 1080p resolution, is very difficult to manipulate effectively and is one of the current strongest considerations for physical identity to match other identity records.

- Central KYC: this type of KYC incorporates a complete mini-ecosystem of KYC implementation where records are stored. This is what is more commonly seen as “the other side” of the KYC process. For example, if you need to give a passport to validate your identity, the Central KYC in this case is the issuer of the passport and the authority it represents that confirms your identity.

- Mobile KYC: often part of the digital and video aspects of KYC, mobile-based KYC is any means of identity that can be used via a mobile device. This includes but is not limited to pictures, video, audio, emails and passwords, two-factor authentication, ID cards that are stored on the device, or even things like location.

- Offline KYC: using KYC through technology has been a staple for some time, but doesn’t always need to be the de facto form of proving identification and risk. Offline KYC is exactly what it sounds like. It is a form of understanding customers without using things like the internet, media, or devices. Usually, this relies very directly upon Central KYC systems. Offline KYC can be things like in-person meetings, fingerprints, DNA and blood verification, or documents like tax returns, utility bills, income statements, and more.

- In-Person KYC: closely related to Offline KYC, using KYC can be done explicitly in person. This is done using many of the same methods as offline KYC but mainly includes physically being at a location to verify identity. This is often used to set up Central KYC or certain services like buying a home where location is a requirement anyway.

Why Is The KYC Process Mandatory?

When using a service or product for a business, and even for us at ScaleSwap, you will find that the KYC process is mandatory and something that cannot be opted out of. There are multiple reasons why a consumer-facing entity would need to use it, mainly to protect the interest of the business and guide consumers through a fair experience. Making it mandatory allows letting everyone that has made it through the KYC process to be safer knowing that there have been security measures taken to prevent unnecessary risks.

For ScaleSwap, it is important that KYC is used since this significantly reduces the risks of anonymous hacking or exploits of the network and the projects involved. Many of the projects are early stage and often first-round public IDO projects and an exploit would devastate their public exposure. Furthermore, IDO projects are usually compliant with KYC on their end, so it makes sense that all parties involved share the same level of security and verification. Overall this helps to keep Scaleswap and our launching projects on the right side of the evolving regulatory landscape and also make things as fair as possible for IDO participants.

What Triggers KYC?

Not only is KYC used for the overall due diligence of businesses and consumers, but certain events can trigger a KYC event in order to capitalize on extra service or because of an event that took place. Event triggers for KYC come in all shapes and sizes, but mainly come as a result of some of the following that take place:

- Unusual Transaction Activity: when there is a structured form of business, usually there is already an established method of how people typically behave. When something is unusual in a consumer’s activity, then this usually flags an account and KYC can be triggered to confirm the activity is legit or cause for concern. For things like bank accounts, this typically comes in the form of large spending purchases or usual purchases that don’t reflect the previous history.

- New Information of Changed Client Information: whenever there is new information or something that needs to be changed in order to update verification, KYC can be used to help verify this change. In many cases changing information like relocation of a home address, phone number, the form of identification, passwords, or methods to withdraw funds can all trigger an event.

- Change of Client Occupation: if a client happens to change jobs or occupations, this is likely to trigger a KYC event. One of the reasons this will create a KYC event is to maintain a flow of income that is relevant or shows a client can resume their end of the service as before. In many cases, job changes can create rifts and challenges in income and this helps ensure the business suffers no added risk from a change committed by the client.

- Change of the Nature of Business: business owners sometimes keep the same business but change the nature of what they offer, which can also trigger a KYC event. The same reasoning for occupation changes is present here so that businesses don’t gain added risk for a decision made beyond their control.

- Adding New Parties to an Account: when a client has an account and wants to add another person to the account, such as a spouse, then this also triggers a KYC event since the new person will have their own set of risks.

What Are KYC Requirements?

When customers are trying to comply with KYC regulations, it can be difficult to understand what exactly is needed as many businesses have different requirements. In most cases, major changes in ones like owning a home or traveling overseas require larger KYC requirements than otters. Other things like signing up to use a software service might be something as small as an email.

Some of the most common forms of KYC requirements require centralized KYC methods that have a certain authority to confirm your identity. This includes but is not limited to passports, permanent residence cards, driver’s licenses, birth certificates, employee cards, utility bills, tax returns, or registration. Other forms that are still central in nature but pertain more to a specific voluntary service are things like biometrics for smartphones, emails, GPS verification, or voice recognition.

How Much Does KYC Cost?

Using KYC as a whole is no cheap task for the average business. For businesses like financial institutions, KYC can cost the company upwards of $500 million or more, with large companies like JPMorgan sometimes spending $1 billion to abide by KYC compliance requirements. This also gives extra concern for a business that they have a strict compliance process that reduces the amount of risk as much as possible since KYC is in part a business investment for them.

In the case of a crypto startup using KYC through the fundraising and IDO stages, a KYC solution would typically cost between $4,000 – $10,000 dollars.

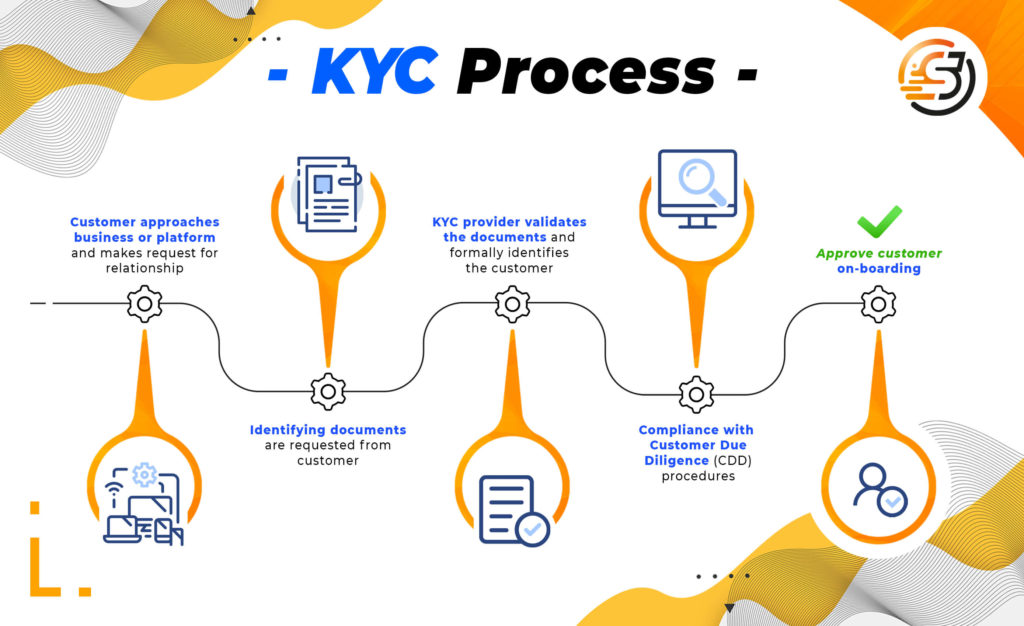

The KYC Process

With all the documents, methods of proving KYC, and options involved, it’s no surprise that there is typically a mainstream process to verifying KYC and it’s not typically an instant process. Although the KYC process itself can be dynamic, there are usually five steps involved in making sure customer verification is maintained for optimal results:

- Customer ID Setup: this is the initial part of the KYC process and also the most common associated aspect of KYC from the customer side. This typically involves handing the correct KYC documents and methods of verification over to the businesses that require it.

- Watch List Screening: Once the setup is complete, the businesses or party will check the customer verification with known watchlists and cross-reference them for any unusual activity, risk concerns, or contrasting data that does not align with the business. This sounds scarier than it seems, but basically, this is an easy way to snuff out people that already have a previous record that does not align with the interests of the business.

- Regulatory Compliance: this is an aspect of the KYC process where businesses also need to align themselves with the proper method of KYC that is issued wherever they do business. Most businesses are required to comply with certain rules based on the Central KYC that they accept.

- Risk Assessment: once everything is squared away, the businesses can verify the KYC information and then determine if that customer or client is worth taking the risk for the business needs. Passing a KYC process does not automatically approve a customer to work with the businesses.

- Periodic Review: if the client passes the KYC check and gets accepted to do business with the company, there are sometimes periodic reviews using KYC to maintain the status quo on the client’s business relationship.

Some KYC Laws From Around The World

The concept of KYC itself is not new nor is it exclusive to one part of the world. There are many places and great examples of using KYC around the globe and how it maintains a healthy relationship with consumers and businesses. Acuant has a credible checklist of countries around the world and their respecting KYC compliance issuers. This helps maintain not only regional KYC laws which may change depending on the rules of each country, but also on an international level so that counties can communicate effectively on behalf of consumers.

Conclusion

If you’re behind a crypto startup that is approaching a launch to the market, it’s crucial for you to carefully consider your KYC strategy. Scaleswap is proud to offer support and resources, as well as assistance when it comes to navigating KYC requirements to ensure regulatory compliance and the overall success of your launch. Time and effort are precious so let our experienced team help you with your IDO and KYC strategy so your team can keep its focus on shaping the future.

Scalescore

Scalescore